If you’re getting started in the cryptographic world, you’ve likely heard two fundamental concepts: Proof of Work (PoW) and Proof of Stake (PoS). These terms, originating from English (Proof of Work or Proof of Stake in Spanish), are the 2 fundamental consensus mechanisms that underpin the security and integrity of cryptocurrencies and decentralized networks. In this article, we will thoroughly explore the differences between Proof of Work and Proof of Stake, breaking down their differences, advantages, and drawbacks. As the blockchain industry rapidly evolves, understanding these terms becomes crucial for both enthusiasts and investors.

What is a consensus protocol and why is it necessary in Blockchain?

Before delving into the differences between Proof of Work (PoW) and Proof of Stake (PoS), it’s essential to grasp the underlying concept that unites these two technologies: the consensus protocol. In the world of cryptocurrencies and blockchain technology, a block consensus protocol is the set of rules and procedures guiding how nodes in a decentralized network reach an agreement on the current state of the ledger, or blockchain.

In simple terms, we could equate the consensus protocol in a blockchain network to the rules of the game in a sports tournament. Imagine each participant in the tournament represents a node on the blockchain network, and the goal is to achieve a consensus on what is the correct and updated version of the transaction history. These consensus protocols are like the referee of the game, setting clear rules and methods to ensure all participants agree on a shared truth. Without a robust consensus protocol, blockchain networks couldn’t operate reliably and securely.

Discovering Proof of Work or Proof of Work Protocol (PoW)

Within the cryptographic ecosystem, the Proof of Work Protocol, or Proof of Work (PoW), stands out as the solid protocol that has underpinned some of the most influential digital currencies, among which Bitcoin shines brightly. In essence, Proof of Work is an ingenious consensus mechanism that transforms the resolution of complex mathematical problems into a powerful tool for validating transactions on the blockchain. In this digital ballet, miners compete to be the first to solve these cryptographic puzzles, thereby demonstrating their dedication and contribution to the maintenance of the decentralized network.

How does Proof of Work work?

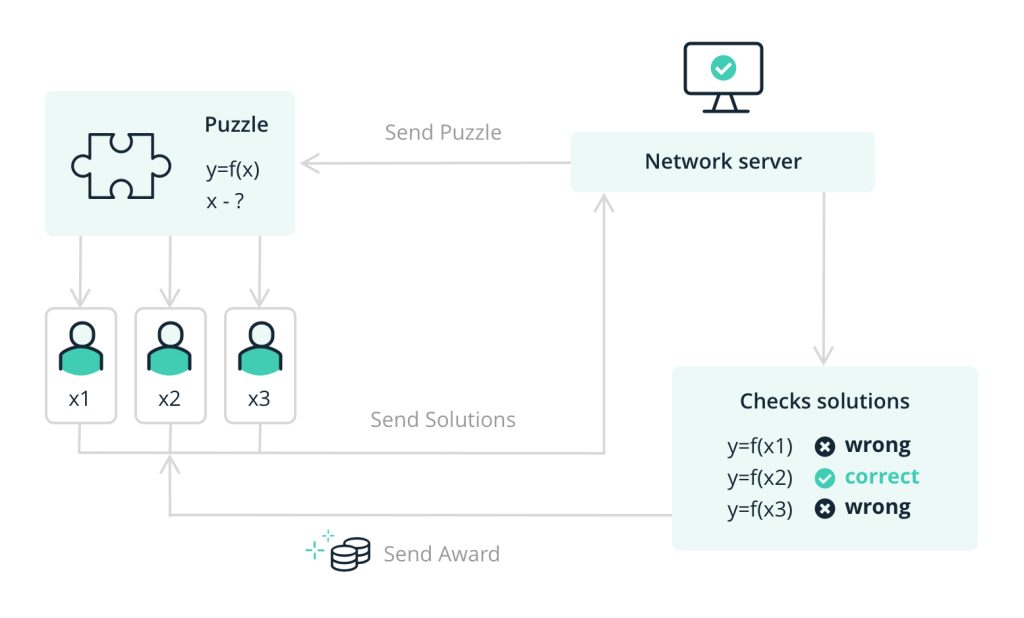

Proof of Work (PoW) is a fundamental consensus protocol in blockchain that uses cryptography and the solving of complex problems to secure and validate transactions. In this process, the network poses challenging cryptographic problems, and miners compete to be the first to solve them. This “proof of work” process requires intense computational power, ensuring that participants expend significant effort. The solution found by the miner demonstrates their work and, once verified by the network, grants them the right to add a new block to the blockchain. In addition to ensuring the integrity of transactions, PoW incentivizes decentralization and the distribution of new coins.

Imagine a mathematical competition where each participant (miner) receives a unique and complex puzzle. This puzzle, designed using hash functions, requires a significant amount of computational power to be solved. Miners compete to be the first to find the correct solution. This competition not only ensures that the validation process is challenging but also introduces an element of randomness that prevents any single participant from consistently controlling the process. Once a miner solves the puzzle and demonstrates substantial work, they are granted the privilege of adding a new block to the blockchain, thus contributing to the security and decentralization of the network.

Despite its effectiveness, this approach is not without criticism, especially concerning energy consumption. This aspect will be explored in depth as we unravel the complexities and challenges associated with Proof of Work.

Advantages of Proof of Work

The Proof of Work Protocol has been a pillar in building and securing blockchain networks, with several notable advantages that have contributed to its prominence and longevity. Below, we break down these advantages in detail:

Proven Security:

- Cryptographic Resistance: PoW uses cryptographic hash functions, making transactions immutable and resistant to tampering. The complexity of the cryptographic puzzles adds an additional layer of security.

- Protection against 51% Attacks: The structure of PoW makes it exceedingly difficult to carry out a 51% attack, where a malicious actor would control more than half of the network’s computational power.

Decentralized Distribution:

- Decentralized Mining: PoW allows for decentralized distribution of mining activity. Unlike some alternative protocols, where decisions can be centralized in the hands of a few, PoW encourages participation froma variety of actors.

- Prevents Coin Concentration: Mining as a process for adding new blocks introduces a form of coin distribution, preventing excessive concentration of wealth in a limited number of participants.

Incentive System:

- Mining Rewards: Miners, by solving puzzles and validating blocks, are rewarded with new cryptocurrencies and transaction fees. This economic incentive motivates participation and contributes to the maintenance and security of the network.

- Fair Competition: Open competition in mining ensures that no actor has an unfair advantage in obtaining rewards, as everyone is subject to the same rules for solving puzzles.

Censorship Resistance:

- Equal Opportunities: PoW offers equal opportunities to participate in transaction validation. Any entity with the necessary computational resources can join the network, promoting inclusivity and preventing censorship.

- Open Participation: The open participation and lack of discriminatory requirements make PoW accessible to a wide range of participants, promoting diversity and resistance to attempts at censorship.

Disadvantages of Proof of Work

Although Proof of Work (PoW) has proven to be robust and reliable, it is not without its disadvantages. Below, we explore in detail some of the challenges associated with this consensus protocol:

High Energy Consumption:

- Environmental Challenge: The main criticism of PoW is its high energy consumption. The competition among miners to solve complex cryptographic puzzles requires a massive amount of computational power, translating into a significant environmental impact. It’s noteworthy that the energy mix for mining, in the case of Bitcoin, increasingly leans towards the contribution of renewable energy sources.

- Questionable Sustainability: The intensive use of energy has led to debates about the sustainability of PoW, especially when compared to more energy-efficient approaches.

Mining Centralization:

- Dominance of Large Pools: As competition in mining intensifies, there has been a centralization within large mining pools, where a small number of participants control a significant proportion of the network’s computational power. This could threaten the decentralization that PoW aims to maintain.

- Collusion Risk: The concentration of power in large pools also poses the risk of collusion, where these actors could coordinate efforts to influence the network, although this goes against individual interests.

Competition for Computational Resources:

- Inequality of Access: PoW mining requires specialized hardware and consumes large amounts of electricity, which can exclude individuals or communities with limited resources. This could lead to centralization in regions with cheaper energy and access to specialized hardware.

- Difficulty of Participation: The increasing complexity of cryptographic problems makes mining increasingly difficult, discouraging participation from small miners and favoring those with substantial resources.

Risk of 51% Attacks:

- Theoretical Possibility: Although extremely difficult, the theoretical possibility of a 51% attack persists in PoW systems. If a malicious actor controls more than 50% of the network’s computational power, they could theoretically manipulate transactions or perform other harmful acts.

- Resource Concentration: The possibility of a 51% attack highlights the importance of maintaining a wide and equitable distribution of mining to prevent resource concentration.

Scalability Challenges:

- Relative Performance: As the network grows, the relative performance of PoW can decrease. The increase in the number of transactions and participants can affect the speed and efficiency of the protocol.

- Variable Transaction Costs: During times of high demand, transaction costs can increase due to competition among miners to include transactions in blocks.

Proof of Stake (PoS): A Revolution in Blockchain Consensus

Proof of Stake (PoS) emerges as an innovative alternative to the PoW consensus protocol, introducing a radically different approach to validating transactions on blockchain networks. Instead of relying on computational power and intensive competition among miners, PoS assigns the right to validate blocks based on a user’s stake in the cryptocurrency in question.

How Does Proof of Stake Work?

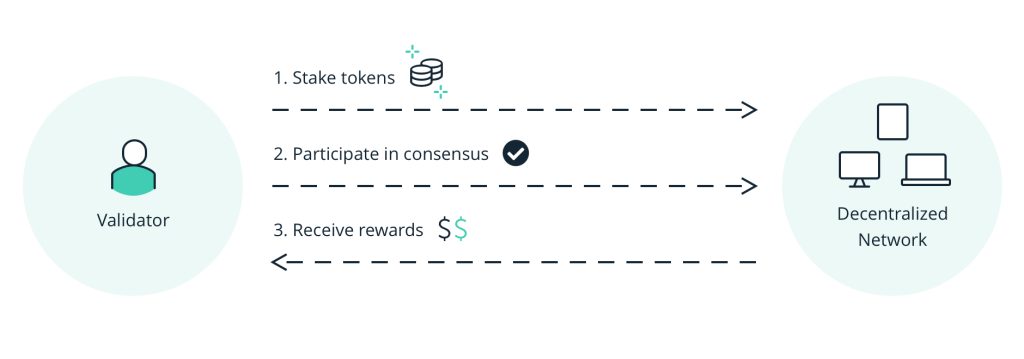

Proof of Stake (PoS) marks a significant shift in how cryptocurrencies validate transactions and maintain their networks. Unlike PoW, which relies on computational power competition among miners, PoS grants the right to validate blocks and add them to the blockchain based on the possession and staking of cryptocurrencies by participants.

In PoS, participants, called validators, must “stake” or lock up a specific amount of the network’s native cryptocurrency. These validators are selected to propose and validate blocks either deterministically or probabilistically, and the probability of selection is directly linked to the amount of cryptocurrency they have staked. The stake of the participants acts as their “skin in the game” and serves as collateral. If a validator acts maliciously, such as attempting to double-spend, they can face penalties, including the partial or total loss of their stake. This penalty mechanism acts as a strong incentive for validators to act honestly and in the best interest of the network.

Unlike PoW, PoS offers notable energy efficiency by eliminating the need for resource-intensive calculations to solve cryptographic problems. The selection of validators is based on the amount of cryptocurrency they hold, which significantly reduces the environmental impact associated with mining. Successful validators receive rewards in the form of transaction fees and, in some cases, new cryptocurrencies created during the validation process. This economic incentive system motivates participants to actively contribute to the security and maintenance of the network. Moreover, PoS offers greater scalability by eliminating the need for intensive calculations to compete for validation. The validator selection process can be more efficient, allowing for greater participation and contributing to a more decentralized network.

Advantages of Proof of Stake

The Proof of Stake (PoS) consensus protocol offers several advantages that have driven its growing adoption and consideration in the cryptocurrency space. Below are the main advantages of PoS:

Energy Efficiency:

- Reduced Energy Consumption: PoS eliminates the need for resource-intensive calculations, in contrast to PoW. By basing on the amount of cryptocurrencies held instead of computational power, PoS is considerably more energy-efficient, addressing criticisms regarding the sustainability of PoW.

- Lower Environmental Impact: The energy efficiency of PoS positions it as a more sustainable and environmentally friendly option, responding to concerns about the massive energy consumption associated with cryptocurrency mining.

Economic Incentives and Active Participation:

- Ownership-Based Participation: Validation in PoS is based on the amount of cryptocurrencies staked as collateral. This participation incentivizes cryptocurrency holders to be an active part of the network and contribute to its security and maintenance.

- Rewards for Validators: Validators are rewarded with transaction fees and, in some cases, new cryptocurrencies. This economic incentive system motivates participants to act honestly and in the best interest of the network.

Decentralization and Attack Resistance:

- Lower Risk of 51% Attacks: The nature of PoS significantly reduces the risk of 51% attacks, as the amount of cryptocurrencies needed to effectively compromise the network is prohibitive.

- Promotion of Decentralization: By basing on cryptocurrency possession instead of processing capacity, PoS encourages a more equitable distribution of validation, contributing to the decentralization of the network.

Greater Scalability:

- Efficient Selection Process: PoS eliminates the need to compete for validation through complex calculations, allowing for a more efficient and scalable validator selection process.

- Increased Participation: The efficiency of the selection process facilitates greater participation from cryptocurrency holders, contributing to a more robust and decentralized network.

Disadvantages of Proof of Stake (PoS): Challenges and Critical Considerations

While Proof of Stake (PoS) offers numerous advantages, it is not without its disadvantages and challenges. Here, we explore the main limitations associated with this consensus protocol:

Concentration of Wealth Risk:

- Continuous Accumulation: PoS assigns the right to validate blocks based on the amount of cryptocurrencies owned. This could lead to a greater concentration of wealth over time, as those with more assets are more likely to be selected as validators.

- Inequality Challenge: Participation based on ownership could contribute to the consolidation of economic power in the hands of a few, potentially eroding the decentralization that PoS aims to maintain.

Risk of Unfair Penalties:

- Potential for Unfair Penalties: While penalties are a deterrent mechanism, there may be situations where validators face unfair penalties due to unpredictable network conditions or misunderstandings.

- Incentives to Leave the Network: The possibility of losing assets as a result of penalties could incentivize some participants to leave the network rather than facing potential risks.

Transition Challenges:

- Complexity in Migrations: Transitioning from a PoW-based network to PoS or even between different variants of PoS can be complex. Planning and executing such migrations can present challenges and require broad consensus within the community.

- Impact on Trust: Poorly managed transitions could affect the community’s trust and the perception of the network’s stability.

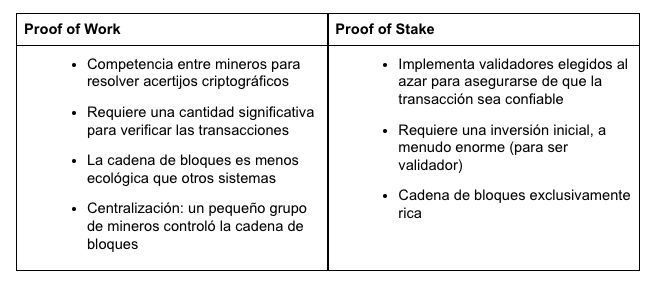

Key Differences between Proof of Stake (PoS) and Proof of Work (PoW) in the Blockchain Context

Ultimately, the choice between PoW and PoS will depend on the specific goals of the project and considerations such as sustainability, the desired level of decentralization, and accessibility for participants. Some projects may choose to combine elements of both protocols to leverage the strengths of each.