Bitcoin or BTC, created in 2008 by the enigmatic pseudonym Satoshi Nakamoto, emerged as an alternative to the current financial/monetary system, and its success has been notable like no other currency not issued by a central bank. However, its success is primarily due to the qualities of the asset itself, such as decentralization and its decreasing limited supply, and this is where the Bitcoin Halving comes into play. This is a scheduled event that occurs approximately every four years, playing an essential role in the issuance and total supply of this cryptocurrency. During this event, the reward that miners receive for solving each block is halved, directly impacting the rate of production of new bitcoins. Historically, it has been a precursor to significant surges, but let’s remember that past returns do not guarantee future returns! In this post, we will delve into the fundamental importance of the Halving as well as historical events surrounding this event.

What does the Bitcoin Halving consist of?

The Halving is an event that occurs approximately every 4 years, involving the halving of the reward that miners receive for each block. This event takes place after 210,000 mined blocks, which is roughly 4 years. It is crucial to understand that this estimation is an approximation and not an exact time marker. The Bitcoin network dynamically adjusts the mining difficulty to ensure that, on average, a block is mined every 10 minutes. Since the block generation rate can vary due to network congestion, the exact interval between Halvings may shorten or lengthen. This dynamic adjustment is part of Bitcoin’s adaptive design to maintain a new coin issuance closer to the original plan, which dictates the creation of a new block every 10 minutes.

This reduction in the mining reward is a mechanism to control the total issuance of Bitcoins. As the amount of new bitcoins generated per block decreases, the supply in the market is limited. This process, in economic theory, contributes to the perception of scarcity, an element that has historically influenced the valuation of Bitcoin.

And you might wonder, what is it, and why do BTC miners receive a reward? They receive a reward as an incentive for validating and adding new blocks to the blockchain. This reward, initially set at 50 bitcoins per block, is granted to compensate for the energy expenditure and computational resources that miners invest in securing and maintaining the Bitcoin network.

Halving present in the source code of Bitcoin.

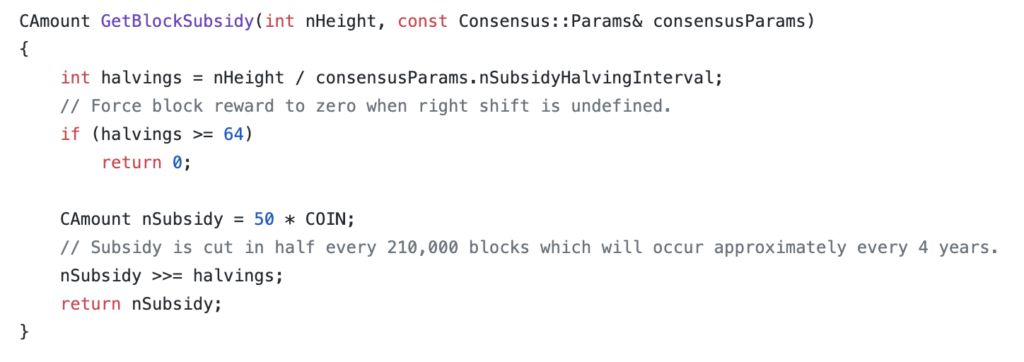

This event is reflected in the cryptocurrency’s source code, and its initiation is a preprogrammed consequence that reflects Satoshi Nakamoto’s vision to limit the total supply of bitcoins. To understand how this event starts, it is necessary to explore certain aspects of the Bitcoin source code.

The source code of Bitcoin is the set of instructions and programmatic rules that defines the operation of the cryptocurrency. Bitcoin’s source code is mostly written in C++ and is available as open-source software. The primary repository for Bitcoin’s source code is hosted on the GitHub platform. It serves as the fundamental protocol governing the creation, transaction, and security of bitcoins, providing the technological foundation and consensus regulation for the decentralized Bitcoin network. In essence, the source code is the “bible” of Bitcoin, outlining the rules of the game for this innovative form of digital money.

In broad terms, the activation of the Halving process is carried out through a specific function in the code. This function, responsible for managing the block reward, sets a new subsidy, resulting in a 50% reduction in the amount of bitcoins that miners receive when adding a block to the blockchain. This event, triggered every 210,000 blocks, stands as a key component of Bitcoin’s technical machinery, directly influencing the dynamics of cryptocurrency issuance and supply.

Why is the Halving important?

The Halving is crucial for Bitcoin because it introduces a preprogrammed reduction in the rate of new bitcoin creation, maintaining a limited supply and establishing an intrinsic mechanism of scarcity. By decreasing the reward for miners, the aim is to keep a controlled supply of bitcoins in circulation. This contrasts with traditional currencies issued by central banks, as Bitcoin is not subject to the uncontrolled printing of additional units, thus safeguarding its long-term value (inflation).

The supply limitation is intensified due to the loss of bitcoins in inactive or “dead” addresses. Over time, some bitcoins become inaccessible due to the loss of private keys or addresses that are no longer used. This constant loss contributes to the diminishing nature of the available supply of bitcoins.

Miners play an essential role in this scenario, as, despite the reduction in the reward, their participation is necessary for transaction validation and network security. Their function becomes even more critical with the decrease in direct rewards, as transaction fees and an increase in the price are expected to offset part of this loss of income.

Historical Background of the Halving

The Bitcoin Halving has been an anticipated phenomenon closely followed by the crypto community, leaving notable marks in the cryptocurrency’s history. Let’s explore the historical background through past dates and the repercussions on the price and prominence of Bitcoin. Keep in mind that past returns do not guarantee future returns!

November 2012 – First Halving:

In the first Halving, which took place in November 2012, the block reward was reduced from 50 to 25 bitcoins. In the months leading up to the event, Bitcoin experienced a significant increase in its price, rising from a few dollars to around 12 USD. Subsequently, in the months following the Halving, the price continued its gradual ascent, reaching levels near 270 USD in 2013.

July 2016 – Second Halving:

In the second Halving, which occurred in July 2016, the reward was reduced to 12.5 bitcoins per block. Unlike the first event, Bitcoin had already gained prominence and widespread adoption. In the months leading up to the Halving, the price increased significantly, surpassing 600 USD. The post-Halving cycle was even more pronounced, leading Bitcoin to reach levels near 2,500 USD in 2017, solidifying the cryptocurrency as an asset of great interest to institutional and retail investors alike.

May 2020 – Third Halving:

The third Halving, which occurred in May 2020, reduced the reward to 6.25 bitcoins. In the months leading up to the event, Bitcoin experienced a notable increase in its price, surpassing 10,000 USD. The Halving coincided with a period of growing institutional interest, contributing to the price reaching historic levels of around 69,000 USD in April 2021. This cycle further reinforced the perception of Bitcoin as a store of value and an asset with significant appreciation potential.

The Future on the Horizon: Bitcoin Halving in 2024

As we move towards the upcoming Bitcoin Halving scheduled for 2024, expectations and interest in the event are intensifying. This next episode in Bitcoin’s timeline is anticipated to occur around May 2024, marking the continuation of the reward reduction saga and its potential implications on the price and perception of the leading cryptocurrency. You can see the real-time countdown here.

Although predicting the exact impact on the price with certainty is a challenge, past cycles have established a pattern of increased attention and valuation of Bitcoin in the months leading up to and following the Halving. The scarcity narrative, as the reward is halved, is expected to remain a fundamental component in the psyche of investors and enthusiasts. In this context, it is important to consider the evolution of the cryptocurrency ecosystem in the intervening years. Changes in institutional adoption, regulations, and technological developments can add significant nuances to the upcoming Halving cycle. Additionally, global awareness of cryptocurrencies has reached unprecedented levels, which could influence market dynamics.

Similarly, the arrival of a Bitcoin Exchange-Traded Fund (ETF) has been a trending topic in the crypto community and could play a crucial role in the narrative surrounding the 2024 Halving. A Bitcoin ETF would allow investors to access Bitcoin through traditional platforms, removing some barriers that have deterred certain market participants. The creation of an ETF could open the doors to greater institutional participation, as many financial institutions prefer to invest through more familiar and regulated investment vehicles such as BlackRock, Fidelity, etc. This, in turn, could drive demand for Bitcoin, especially in the period leading up to the Halving when market attention is typically on the rise. The ETF narrative could focus on legitimizing Bitcoin as a conventional investment asset, attracting investors who were previously cautious due to the perception of cryptocurrency as a more speculative asset.

Furthermore, the enhanced accessibility and liquidity offered by an ETF could be catalysts for widespread adoption. The adoption of emerging technologies is often driven by integration into existing financial systems. The possible arrival of an ETF could mark a significant step towards integrating Bitcoin into the traditional financial fabric, generating a new wave of interest and participation in the cryptocurrency.