We develop your real estate tokenization platform in Costa Rica.

We develop customized solutions for real estate tokenization in Blockchain.

Contact us today

Tailor-made development of real estate tokenization platforms in Costa Rica

We develop scalable Blockchain solutions, based on user experience and efficient smart contracts.

Development 100% In-House

We stand out for offering customized developments, executed by our internal team without resorting to outsourcing or in the search for cost efficiency.

We are your technology partner

We are not a common development company, we partner with you as technology partners, aligning objectives to achieve better results.

Regulatory Compliance

We adopt a rigorous approach to regulatory compliance, adapting technology to legal norms and standards, to save you worries

What is real estate tokenization?

Real estate tokenization the process of transforming physical real estate assets, into digital tokens that are recorded on a blockchain. This approach seeks to increase the liquidity and accessibility of real estate investment.

Real estate tokenization in Costa Rica is developed on Blockchain technology, a distributed technology that operates as an accounting ledger of transactions.

Our work methodology in Costa Rica

first step

Project Analysis

We immerse ourselves in your company to fully understand your objectives and needs.

1

Second step

Custom Development

We design and develop customized blockchain solutions that align with your specific requirements.

2

third step

Continuous Support

We offer Continuous Support and Guarantees to ensure that the developments comply exactly as agreed from the beginning.

3

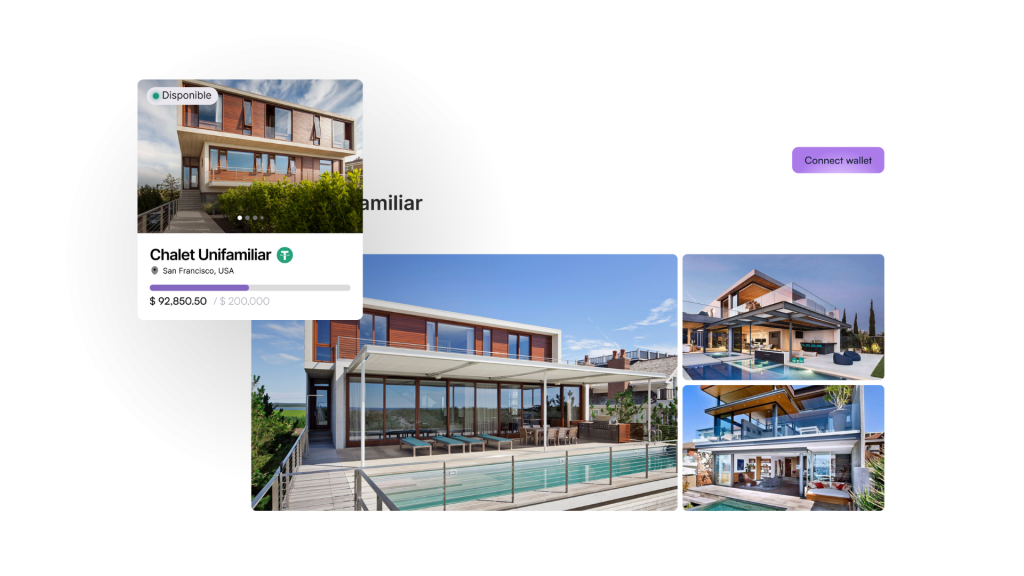

We develop real estate tokenization platforms.

At Metlabs we are dedicated to the integral development of Blockchain projects. We offer customized solutions for real estate tokenization. We will tailor-make your project, from a strategic and technological approach, guaranteeing the best user experience and a solid technological infrastructure.

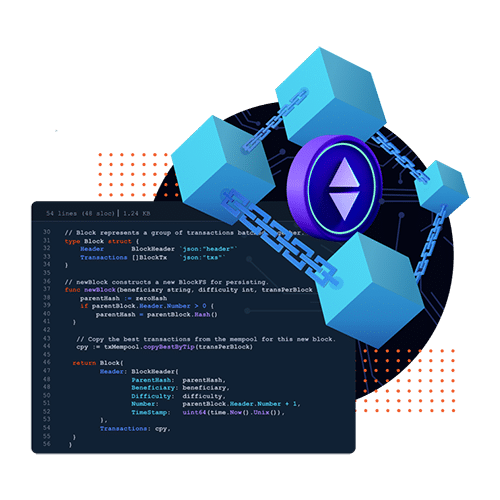

New ERC-3643 Standard for RWA tokenization

The Ethereum ERC-3643 standard was born as a protocol for Real World Asset (RWA) tokenization, providing a standard framework for the representation of tangible assets on the Ethereum blockchain. The standard enables the issuance of tokens that represent real-world physical assets, such as real estate, artwork, vehicles or other tangible assets. It defines specific smart contracts that manage the issuance, transfer and management of RWA tokens.

How do we build your real estate tokenization platform?

UX/UI interface design

UX/UI design starts with user research, followed by the creation of interfaces in Figma to reflect ideas and branding.

Front-end and Back-end development

The next step is to develop the front-end and back-end with React.js, Node.js, Next.js and MongoDB, ensuring an optimal user experience.

Smart Contracts Development

The final step is to implement Smart Contracts in Solidity for the Real State dapp, ensuring its security with advanced audits.

What is a dapp or decentralized application?

A real estate tokenization DApp is a decentralized application that uses blockchain technology and smart contracts to fractionalize and represent real estate assets in the form of cryptographic tokens. In this type of DApp, smart contracts are used to establish specific rules and conditions for the issuance, distribution and management of real estate tokens. Each token represents a fraction of the underlying real estate property, allowing investors to acquire and own specific parts of a real estate asset without the need to purchase the entire property.

Solve your doubts about real estate tokenization

Developing a tokenization DApp involves several steps and the use of blockchain technologies. By way of summary, here is a general approach and how Metlabs could contribute to the process:

- Planning and Conceptualization:

- Defines the purpose and objectives of the real estate tokenization DApp.

- Identifies relevant legal and regulatory requirements.

- Choice of Blockchain Platform:

- Select a blockchain platform that supports token issuance and management. Ethereum is commonly used, but others such as Binance Smart Chain or Solana are also options.

- Development of the Smart Contract:

- Create a smart contract that manages the issuance, transfer and redemption of tokens.

- Implements business logic specific to real estate tokenization.

- User Interface (UI) and User Experience (UX) development:

- Design the user interface so that users can interact with the DApp easily and intuitively.

- Make sure the user experience is friendly and secure.

- Connection with the Blockchain Network:

- Implements the connection of the DApp to the selected blockchain network.

- Configure the DApp to interact with the smart contract and perform operations on the blockchain.

- Integration of Tokenization Functionalities:

- Integrates functions that enable tokenization, distribution and management of real estate assets.

- It incorporates security mechanisms to protect the integrity of information and transactions.

- Security Testing and Auditing:

- Performs extensive testing to ensure the security and functionality of the DApp.

- Consider conducting security audits to identify potential vulnerabilities.

- Deployment and Maintenance:

- Deploy the DApp on the chosen blockchain network.

- Provides ongoing support and performs upgrades as needed.

We are a software and blockchain company, we offer specialized services in every stage of DApps development. This includes advice on blockchain platform selection, smart contract development, user interface design, security testing and auditing, as well as deployment and ongoing maintenance. Contact us and start your project.

Launching a tokenization project involves a number of key considerations to ensure project success and regulatory compliance. Here are some important things to keep in mind:

Legal and Regulatory Framework:

- Research and understand local and international regulations related to tokenization and cryptocurrencies.

- Collaborate with legal counsel specializing in blockchain and finance to ensure regulatory compliance.

Token Type:

- Decide what type of token you will issue (e.g. utility tokens, security tokens or stablecoins) and make sure you comply with the relevant regulations.

Choice of Blockchain:

- Select the blockchain that best suits your project objectives, considering factors such as scalability, transaction costs, security and development community.

Smart Contract:

- Develop a robust and secure smart contract that will manage the issuance, transfer and any business logic associated with your tokens.

Business Model:

- Clearly define your business model, including how investors and users will benefit from your tokenization platform.

Security:

- Implements robust security measures to protect digital assets and user data. This includes security audits and secure development practices.

The choice of blockchain to launch a tokenization platform depends on several factors, including your project's specific requirements, scalability, security, costs and development community. Here are some popular blockchains you might want to consider:

Ethereum:

- Ethereum is one of the most widely used blockchains for DApps development and token issuance. It is known for its smart contracts and its large developer community.

Binance Smart Chain (BSC):

- BSC is a blockchain compatible with Ethereum but with lower transaction fees. It is a popular choice for projects looking to benefit from Binance's infrastructure.

The choice will depend on factors such as scalability, security, transaction fees, ease of development and developer community. In addition, be aware of the regulation and legal framework in the jurisdiction in which you will operate.

Each blockchain has its own strengths and weaknesses, so carefully evaluate which one best aligns with the specific goals and requirements of your tokenization platform.

The legality of real estate tokenization may vary depending on jurisdiction and local laws. In many places, real estate tokenization is at a nascent stage and there is still no specific regulation to address it. However, some jurisdictions are beginning to consider and develop regulatory frameworks for token offerings and asset tokenization.

In the context of real estate tokenization in Spain, some projects may explore the possibility of using participating loans as a way of structuring the investment. Investors could participate by providing loans to the entity representing the tokenized real estate asset, and returns could be generated through specific agreements stipulated in the contract.

As regulations may change and evolve over time, it is strongly recommended to consult with legal advisors and financial experts before participating in any real estate tokenization project in Spain or elsewhere.

Latest publications on Blockchain technology

Smart Contracts in Insurance: Automating Claims and Policies