Bitcoin, created by an individual or group of people under the pseudonym Satoshi Nakamoto, is the world’s first decentralized cryptocurrency, launched in January 2009. Contrary to common belief, Bitcoin is more than just a digital currency; it is an innovative payment system and a new form of money that uses a distributed ledger technology called blockchain to facilitate secure and anonymous transactions.

Bitcoin is based on a decentralized network of nodes that maintain a copy of the ledger, known as the blockchain. This technology allows transactions to be verified by network participants (miners) through a process known as proof of work (PoW). Each transaction is grouped into a block, which is then added to the blockchain after being validated, creating a permanent and immutable record of all transactions made.

Unlike centralized systems, Bitcoin’s blockchain is not controlled by any entity or government, offering advantages in terms of security, privacy, and resistance to censorship. However, it is important to clarify that Bitcoin does use a blockchain, contrary to the idea that “it is not a blockchain as such.” It is precisely this blockchain technology that underpins Bitcoin’s operation, allowing its decentralized operation.

Ethereum (ERC-20) and its launch in 2015:

Ethereum, on the other hand, is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps) without the risk of fraud, censorship, or third-party interference. It was proposed in 2013 by Vitalik Buterin and officially launched in July 2015, not in 2017. Unlike Bitcoin, which focuses on being a means of storage and value transfer, Ethereum extends the use of blockchain technology by allowing developers to write code that runs on the blockchain, known as smart contracts.

These smart contracts automatically execute when certain pre-established conditions are met, without the need for intermediaries. This has opened up endless possibilities for process automation, from the creation of transparent voting systems to the automation of financial workflows and the execution of legal agreements.

- Purpose and application: Bitcoin was created as a digital alternative to money, primarily focused on being a means of payment and value storage. Ethereum, on the other hand, was designed as a platform to facilitate smart contracts and decentralized applications, significantly expanding the uses of blockchain technology beyond financial transactions.

- Consensus technology: Both platforms initially used the proof of work consensus mechanism, although Ethereum has been moving towards a proof of stake (PoS) model with its update to Ethereum 2.0, seeking to improve scalability and reduce energy consumption.

- Programming capability: Ethereum introduces the concept of a Turing complete programming language (Solidity) that runs on the blockchain, allowing the creation of complex contracts and applications.

What is BRC-20?

The BRC-20 standard represents a significant milestone in the evolution of the Bitcoin network, marking the beginning of a new era of tokenization on the world’s oldest and most secure blockchain. Through technological innovation and the implementation of Ordinals and the Taproot update, Bitcoin has extended its capabilities beyond being merely a digital currency to become a platform where both fungible and non-fungible tokens (NFTs) can be issued, without needing to modify its original code.

BRC-20 tokens are a category of digital assets that are issued and managed on the Bitcoin blockchain, leveraging the new functionalities that allow the creation of smart contracts and the tokenization of assets within this network. This innovation opens the door to a wide range of applications and use cases, from the creation of new cryptocurrencies to the digital representation of physical assets, through the issuance of NFTs that can represent art, collectibles, intellectual property rights, and much more.

The Taproot update, implemented in November 2021, plays a crucial role in this development, as it introduces significant improvements in privacy, efficiency, and flexibility of the Bitcoin blockchain. Taproot facilitates the creation of more complex and less expensive smart contracts in terms of space and fees, which is essential for the efficient operation of BRC-20 tokens. On the other hand, the Ordinals initiative inscribes digital information, including BRC-20 tokens, directly into Bitcoin transactions, leveraging the data capacity of satoshi, the smallest unit of bitcoin, to embed these assets within the blockchain.

The introduction of BRC-20 tokens has generated considerable enthusiasm among investors, developers, and cryptocurrency enthusiasts, as it offers new investment and development opportunities within the Bitcoin ecosystem. With a market capitalization already exceeding $1.4 billion for certain tokens, it’s clear that this new tokenized ecosystem is finding fertile ground for growth and adoption.

Furthermore, the BRC-20 standard not only expands Bitcoin’s capabilities as a blockchain platform but also reinforces its position as an innovative and constantly evolving network. By enabling tokenization on its network, Bitcoin is moving beyond its original role as a pure digital currency to become a richer and more diverse ecosystem, capable of supporting a variety of decentralized applications and digital token use cases.

Detailed Explanation of Taproot

Taproot is a significant upgrade to the Bitcoin network, implemented in November 2021, designed to improve privacy, efficiency, and flexibility in the creation and execution of transactions on the Bitcoin blockchain. This improvement focuses mainly on how transaction scripts are managed and revealed, allowing for greater complexity in Bitcoin operations without compromising its security or efficiency. Below are the key aspects of Taproot:

Privacy Improvement

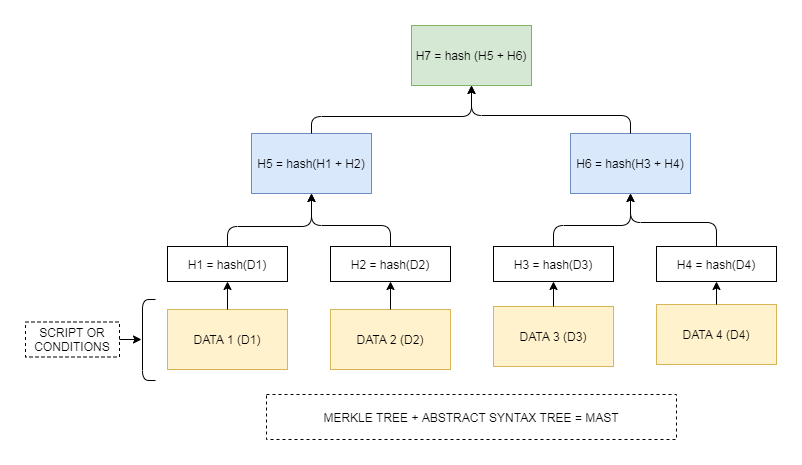

Taproot introduces a technique called “Merkleized Abstract Syntax Tree” (MAST), which allows hiding the complexity of a Bitcoin script until the conditions for its execution are met. This means that only the part of the script used for a specific transaction is revealed, improving user privacy by making all transactions appear externally identical, regardless of their complexity.

Efficiency and Lower Cost

By compacting the information needed to verify a transaction and by making complex and simple transactions appear identical at the blockchain level, Taproot reduces the space that transactions occupy in a block. This not only improves efficiency in terms of space and processing time but can also contribute to reducing transaction fees, as these are often calculated based on the size of the transaction.

Greater Flexibility with Schnorr Signatures

Taproot introduces Schnorr signatures, replacing the previously used ECDSA (Elliptic Curve Digital Signature Algorithm) in Bitcoin. Schnorr signatures offer several advantages, including the ability to combine multiple signatures into one (“signature aggregation”). This not only improves privacy by making it harder to distinguish complex transactions from simple ones but also enhances security and further reduces the space that transactions occupy in a block.

Potential for More Complex Smart Contracts

Although Bitcoin does not offer an advanced smart contract system like Ethereum, Taproot makes it possible to create more complex and efficient contracts in Bitcoin. By allowing complex transactions to be presented and processed in the same way as simple transactions, Taproot opens up new possibilities for the implementation of decentralized financial applications and other types of smart contracts on the Bitcoin network.

Bitcoin Halving in 2024, How Does It Affect BTC?

The Bitcoin halving is a scheduled event that occurs approximately every four years, where the block reward received by miners is cut in half. This mechanism is built into Bitcoin’s code to control inflation, ensuring that the issuance of new bitcoins is reduced over time until reaching the maximum limit of 21 million units. The next halving is scheduled for 2024, and as in previous occasions, it is expected to have a significant impact on the market and Bitcoin adoption.

The reduction in block reward decreases the rate at which new bitcoins are generated, reducing the supply of new bitcoins entering the market. Historically, halvings have preceded periods of price increase in Bitcoin, as the decreasing supply, along with a constant or increasing demand, tends to drive the price up. For miners, the halving directly reduces their bitcoin income, which can lead to a temporary decrease in the network’s hash rate if market prices do not increase to compensate for the lower reward. However, the expected increase in Bitcoin’s price after the halving can help keep mining profitable and ensure the network’s security in the long term.

The halving increases public awareness about Bitcoin, as it usually generates significant media coverage and discussions within the cryptocurrency community. This increased attention can attract new investors and users, boosting adoption. Additionally, Bitcoin’s perception as a scarce asset may be strengthened, often comparing it to precious metals like gold, which reinforces its value as a store of value and “digital gold.” In the long term, the halving reinforces Bitcoin’s economic fundamentals, promoting its scarcity and appreciation potential. This can contribute positively to its adoption as an investment asset and store of value, in addition to its use in transactions and international remittances.