Real Estate Crowdfunding

We facilitate accessible and secure real estate investments through crowdfunding and blockchain.

Contact us today

Secure and Affordable Real Estate Investments

We offer safe and affordable investments in real estate projects through crowdfunding.

Development 100% In-House

We stand out for offering customized developments, executed by our internal team without resorting to outsourcing or in the search for cost efficiency.

We are your technology partner

We are not a common development company, we partner with you as technology partners, aligning objectives to achieve better results.

Regulatory Compliance

We adopt a rigorous approach to regulatory compliance, adapting technology to legal norms and standards, to save you worries

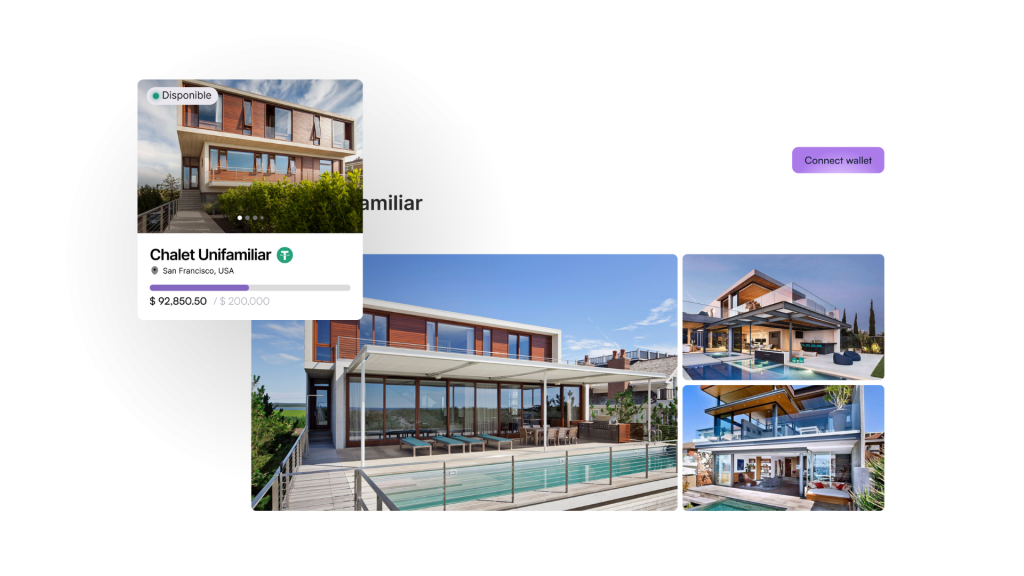

How does Real Estate Crowdfunding work?

Real estate crowdfunding raises funds from investors to finance projects online.

Developers submit their proposals, and investors choose which projects to participate in.

When capital is raised, it is used to develop the property.

Investors receive a share of the proceeds, either from rent, appreciation or sale, as agreed.

Advantages of Real Estate Crowdfunding and Blockchain.

Accessibility: Crowdfunding allows small investors to enter the real estate market with less capital.

Diversification: It facilitates the distribution of investments in various projects, thus reducing risks.

Security and Transparency: Blockchain technology guarantees secure and transparent transactions, minimizing the risk of fraud.

3 Real Estate Crowdfunding Investment Risks

Project Risk

The project may not be completed or may not generate the expected returns, which could result in the loss of the investment.

1

Limited Liquidity

It is difficult to sell the investment before the project is completed, and there are few resale options.

2

3

Regulation and Safety

Supervision and protection vary by region, which may increase the risk of legal problems or loss of funds.

Profitability Potential

Real estate crowdfunding with blockchain offers very attractive returns.

Investors can earn income from rental income, appreciation in value or the sale of properties.

This allows participation in high-potential projects without large upfront sums.

However, profitability depends on choosing the right projects and diversifying to maximize profits and minimize risks.

How do you know if Real Estate Crowdfunding is for you?

Assess your Risk Tolerance

Are you willing to take potential losses? Real estate crowdfunding carries risks that you should consider before investing.

Consider your Investment Horizon

If you prefer long-term investments, this option may be right for you, but if you need quick liquidity, it may not be the best choice.

Compare Yields and Costs

Review historical returns, compare with other investments and be aware of fees that could affect your returns.

Latest Publications on Blockchain Technology

Real estate tokenization in 2025: We develop your tailor-made platform