Best real estate crowdfunding platforms:

- Fundraise

- RealtyMogul

- CrowdStreet

- DiversyFund

- PeerStreet

- Groundfloor

- BrickStarter

- YieldStreet

Real estate crowdfunding is changing the game.

You no longer need to be a millionaire to invest in large real estate projects.

With small investments, you can diversify your portfolio and access incredible opportunities.

Here we show you the best real estate crowdfunding platforms so that you can start investing easily and, above all, safely.

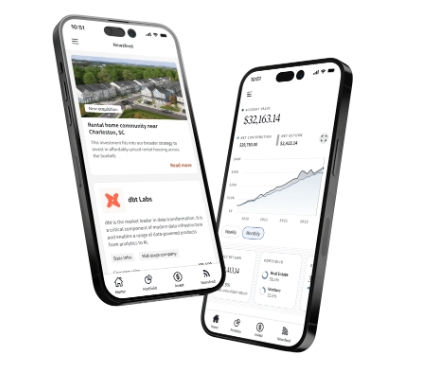

1. Fundrise

Fundrise is very popular in the United States and offers a variety of funds that invest in commercial and residential properties.

Characteristics:

- AccessibleYou can start with as little as $10.

- Diversified: Invests in several projects at the same time.

- AutomaticLet Fundrise manage your investments.

Pros:

- Low minimum investment.

- Transparency in projects.

Cons:

- Mainly focused on the U.S. market.

RealtyMogul

RealtyMogul is another very good option, offering investments in both commercial and residential properties.

Characteristics:

- VarietyFrom apartment buildings to shopping malls.

- Detailed Reports: They keep you informed about the performance of your investments.

Pros:

- Wide range of investment options.

- Detailed and regular reports.

Cons:

- Requires a higher minimum investment amount ($5,000).

3. CrowdStreet

CrowdStreet focuses on large commercial real estate projects, ideal if you’re looking for something bigger.

Characteristics:

- Large Projects: Invest in skyscrapers, shopping malls and more.

- Transparent Platform: Detailed information on each project.

Pros:

- Excellent for large commercial projects.

- High transparency and project details.

Cons:

- Higher minimum investment amounts.

4. DiversyFund

DiversyFund allows you to invest in real estate with an easy-to-use platform.

Characteristics:

- Automatic Growth: Automatically reinvest your earnings.

- Education: Educational resources to better understand your investments.

Pros:

- Easy and automatic access to investments.

- Educational resources for investors.

Cons:

- Fewer investment customization options.

5. PeerStreet

PeerStreet specializes in real estate-backed lending, allowing you to invest in real estate to invest in mortgages.

Characteristics:

- Real Estate Loans: Invest in short-term mortgages.

- Control: Choose in which projects you want to invest.

Pros:

- Control over your investments.

- Good yield potential.

Cons:

- Requires research on each loan.

6. Groundfloor

Groundfloor offers investments in residential renovation projects, ideal for those looking for something short-term.

Characteristics:

- Renovations: Home renovation projects.

- Short Term: Short-term investments with good returns.

Pros:

- Ideal for short-term investments.

- Good return potential.

Cons:

- Risk associated with renovation projects.

7. BrickStarter

BrickStarter is a European option that allows you to to invest in vacation properties.

Characteristics:

- Vacation Properties: Invest in properties for short-term rental.

- European market: Access to the European real estate market.

Pros:

- Geographic diversification.

- Focus on vacation properties.

Cons:

- Focused on Europe, less global options.

YieldStreet

YieldStreet offers a variety of alternative investments, including real estate.

Characteristics:

- Alternative Investments: Not just real estate, but also art, loans and more.

- Affordability: Investments starting at $500.

Pros:

- Diversification in various types of investments.

- Access to unique investments.

Cons:

- It requires a broader understanding of alternative investments.

What is Real Estate Crowdfunding?

The real estate crowdfunding is an innovative way of investing in real estate using online platforms that connect small investors with real estate project developers.

Instead of needing a large amount of capital to buy a property outright, you can invest a much smaller sum and co-own a larger project with other investors, you can invest a much smaller sum and be co-owner of a larger project together with other investors.

How Real Estate Crowdfunding Works in 5 Steps

Real estate crowdfunding is simple and accessible.

Here we explain how it works step by step:

Project Selection

First, the platforms select real estate projects in need of financing.

These can range from the construction of new buildings to the renovation of existing properties.

2. Publication on the Platform

Secondly, the details of the project are published on the crowdfunding platform.

This includes information on location, property type, development plan and expected return on investment.

3. User Investment

As an investor, you can choose in which projects you want to participate.

Investments can be as small as $10 or as large as you want. Your money is added to that of other investors to fund the project from scratch.

4. Project Development

Once the necessary money has been raised, the developer uses the funds to carry out the project.

During this time, the platform will keep you informed about the progress.

5. Return on Investment

When the project is completed and starts begins to generate income (by rent or sale), you will receive your share of the profits.

This can be through regular payments or a lump sum at the end of the project.

4 Advantages of Real Estate Crowdfunding

Investing in real estate crowdfunding has several benefits that make it attractive to many investors:

Accessibility

Unlike traditional real estate investments, crowdfunding allows almost anyone to participate in real estate investments, crowdfunding allows almost anyone to participate, without the need for large sums of money.without the need for large sums of money.

2. Diversification

You can diversify your portfolio by investing in multiple different projectswhich reduces risk by not putting all your eggs in one basket.

Transparency

Crowdfunding platforms usually provide a lot of information about the information about the projects and their progresswhich allows you to make informed decisions.

4. High Return Potential

While all investments carry risk, real estate crowdfunding has the potential to offer high returns. potential to offer high returns, especially inespecially in well-managed projects.

Real Estate Crowdfunding Risks

Like any investment, real estate crowdfunding also has its risks.

Here are a few to keep in mind:

Project Risk

Not all projects will be successful.

You can problems arise during construction or sale that affect your return on investment.

2. Liquidity

Real estate investments are generally less liquid than other investments..

Esto significa que no podrás retirar tu dinero rápidamente si necesitas acceso a efectivo.

3. Market Risks

The real estate market can be volatile. Factors such as changes in the economy interest rates and market conditions can affect the value of your investment.

4. Costs and Fees

Some crowdfunding platforms charge fees for investment management. It is important to understand these costs before investing.

5 Tips for Investing in Real Estate Crowdfunding

If you’re ready to start investing in real estate crowdfunding, here are some tips to help you succeed:

1. Research the Platform

Not all crowdfunding platforms are the same.

Research the platform’s reputation, project history and the opinions of other investors. of other investors.

2. Diversify your investments

Don’t put all your money into one project.

Diversifying into several projects helps you reduce risk and increase return opportunities.

3. Understand the Project Details

Read all available information about the project before investing.

Make sure you understand understand the timelines, risks and expected return.

4. Start with Small Investments

If you are new to real estate crowdfunding, start with small investments to familiarize yourself with the process and to learn and learn without risking too much money.

5. Consult a Financial Advisor

If you have any doubts, do not hesitate to consult a financial advisor.

They can offer you personalized personalized advice and help you make informed decisions.