A security token is a digital representation of a value or right, encoded in a smart contract and issued on a blockchain network. This smart contract contains the rules, rights, and obligations associated with the token, as well as the logic for conducting transactions, dividend payments, voting, or any other function specified by the issuer.

From a technical perspective, security tokens are based on tokenization standards that allow the digital representation of traditional financial assets, such as stocks, bonds, shares of investment funds, or even real estate. These standards, like ERC-20 or ERC-721 on the Ethereum blockchain, define a common set of rules that tokens must follow, facilitating their interoperability and integration with different platforms and digital wallets.

The issuance of security tokens is carried out through tokenization platforms, which use blockchain technology to create, issue, and manage these digital assets. The blockchain offers a decentralized and tamper-proof record of all transactions, ensuring the authenticity, transparency, and traceability of tokens from issuance to transfer or redemption.

Each security token is linked to an underlying asset, project, or company, meaning that the token’s value is directly derived from that asset or the income streams it generates. Smart contract technology automates many of the processes involved in managing these tokens, such as profit distribution, compliance with investment conditions, and execution of rights of token holders, such as voting or buybacks.

In summary, security tokens are digital financial instruments that rely on blockchain technology and smart contracts to represent values or rights over underlying assets, offering an efficient, secure, and transparent means for the issuance, management, and transfer of financial assets in the digital world.

Difference between Utility Token and Security Token

Utility tokens and security tokens represent two categories of cryptographic tokens that differ not only in their applications and uses within digital projects and platforms but also in how they are perceived and regulated by financial authorities around the world. We will now try to explain their differences clearly.

Utility Token

- Purpose and Function: Utility tokens are designed to provide access to a product or service within a blockchain ecosystem. They act as a means for users to interact with the platform, whether to use services, access special features, or pay for transactions. They do not represent an investment in the company or project or rights to its profits.

- Regulation: Generally, they are less subject to financial and securities regulations, as they are not considered investments in the traditional sense. This may vary depending on jurisdiction and interpretation of local laws.

- Usage Examples: Payment for services within a platform (such as transaction fees or access to a cloud storage service), participation in blockchain networks (such as staking to secure the network or voting on governance decisions).

- Technology: They are issued on blockchains using smart contracts, similar to security tokens. Tokenization standards, like ERC-20 on Ethereum, are common to ensure compatibility and ease of exchange.

Security Token

- Purpose and Function: They represent an investment in real assets, rights to dividends, profit shares, or a stake in a company. They are designed to function as digital financial instruments and are subject to financial and securities regulations.

- Regulation: Security tokens must comply with the securities laws and regulations of the country in which they are offered, including registration, disclosure, and compliance requirements to protect investors.

- Usage Examples: Representation of company shares, bonds, stakes in investment funds, or tokenized real estate. They enable the fractionalization of expensive assets and facilitate liquidity and access to global markets.

- Technology: Although they use technologies similar to utility tokens, security token smart contracts often incorporate more complex functionalities to comply with regulations, such as trading restrictions, investor identity verification (KYC), and compliance with anti-money laundering regulations (AML).

Regulation and Legal Aspects in the Issuance of Security and Utility Tokens

In this section, we will address the legal dimension associated with the issuance of crypto assets within corporate structures, focusing on the distinction between the terms of issuance of Security Tokens and Utility Tokens, in the context of Initial Coin Offerings (ICOs) or Security Token Offerings (STOs). It is important to recognize the division between these two classes of tokens: Security Tokens act as investment vehicles, creating in buyers the expectation of financial returns.

Regulatory Landscape for Security Tokens in United States

In the United States, the regulation of security tokens falls primarily under the jurisdiction of the Securities and Exchange Commission (SEC). The SEC has taken a cautious approach to regulating security tokens, treating them as securities subject to the same laws and regulations as traditional securities offerings. This approach involves stringent requirements for registration, disclosure, and compliance with securities laws, such as the Securities Act of 1933 and the Securities Exchange Act of 1934. Companies issuing security tokens must navigate a complex regulatory landscape to ensure compliance and avoid legal pitfalls.

Looking ahead, there is growing anticipation for potential reforms and updates to security token regulation in the United States. Industry stakeholders and policymakers are actively exploring ways to modernize regulations to better accommodate blockchain-based financial instruments while maintaining investor protection and market integrity. Proposed initiatives include the introduction of new legislation or regulatory guidance tailored specifically to security tokens, providing clarity and certainty to market participants.

Regulatory Landscape for Security Tokens in Europe

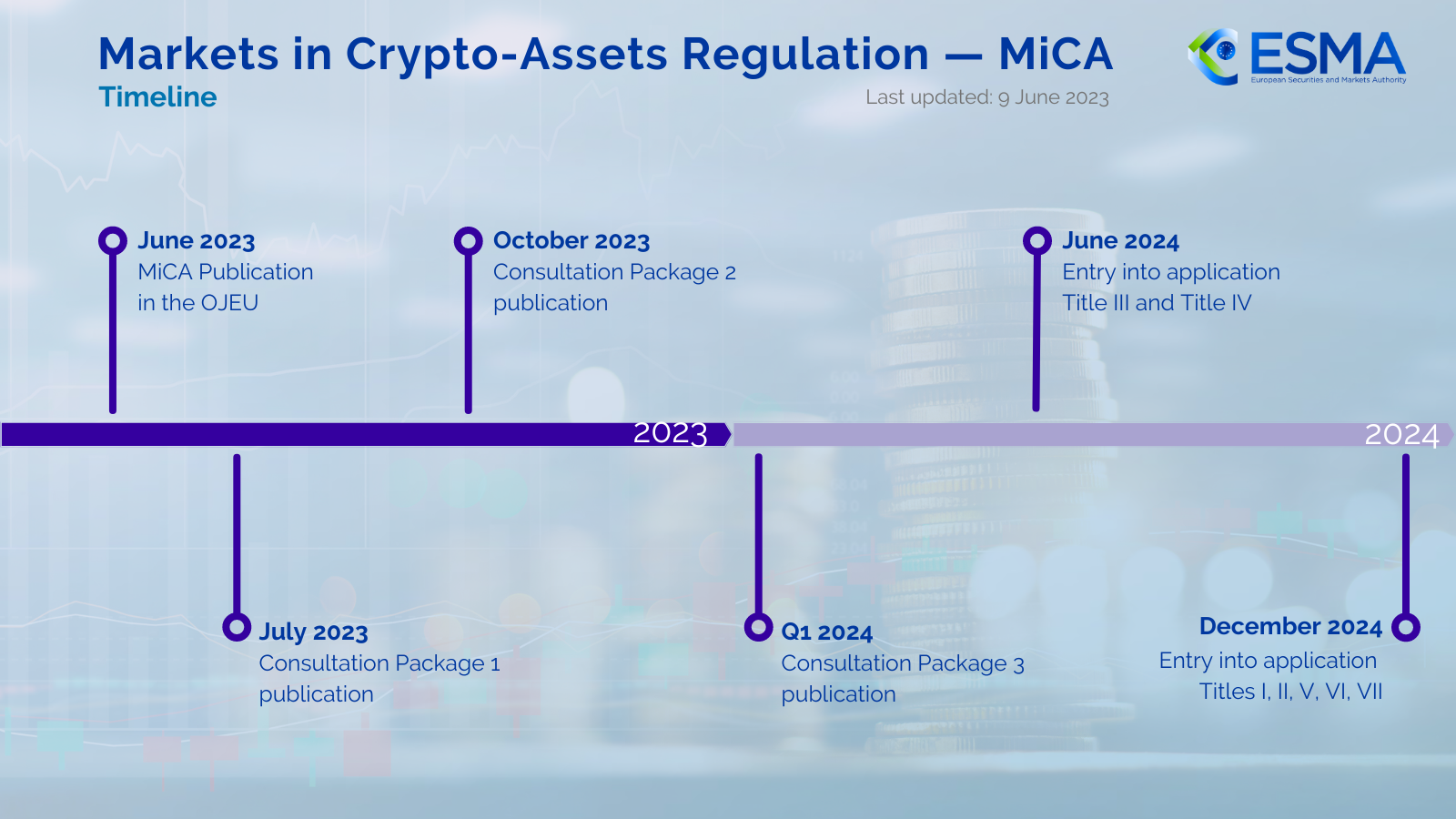

In Europe, the regulatory landscape for security tokens is evolving rapidly, driven by the European Commission’s efforts to establish a comprehensive framework for digital assets. One significant development is the proposed Markets in Crypto-Assets Regulation (MiCA), a legislative proposal aimed at harmonizing rules across the European Union (EU) for crypto-assets, including security tokens. MiCA seeks to create a uniform regulatory regime for the issuance, trading, and custody of crypto-assets, promoting investor confidence and fostering innovation in the digital asset space.

If enacted, MiCA would establish clear guidelines for the classification and treatment of security tokens, defining their legal status and regulatory requirements. This harmonized approach would streamline compliance for companies operating in multiple EU member states, reducing regulatory fragmentation and enhancing the competitiveness of European markets in the global digital asset landscape.

It is important to mention that, according to the European Securities and Markets Authority (ESMA), tokens are “any digital representation that can have value, grant a right to receive benefits or, alternatively, have no specific use or purpose”. Similarly, the European Central Bank (ECB) defines them as “digital representations of existing assets, which facilitate their registration through a different technology”. That is, a digital asset issued that can have its own value or represent any asset within a community, including financial assets.

The regulatory framework in Spain is clarified with the joint statement from the CNMV and the Bank of Spain of February 8, 2018, which establishes the differences between Utility and Security Tokens. This statement is expanded with a document from the CNMV, issued on the same date, which updates and reviews the main criteria, entitled “Considerations of the CNMV on ‘cryptocurrencies’ and ‘ICOs’ addressed to professionals in the financial sector”.

According to this statement, a Utility Token grants rights to access a service or receive a product, while security tokens generally confer participation in future revenues or the increase in value of the issuing entity. It is considered appropriate to exclude from the definition of negotiable value those tokens that do not establish a clear correlation between expectations of appreciation or profitability and the development of the underlying business or project. Tokens that do not qualify as financial instruments according to CNMV criteria will be considered Utility Tokens.

Overall, the regulation of security tokens in both the United States and Europe is undergoing a period of transformation, as regulators adapt to the challenges and opportunities presented by blockchain technology. By fostering a supportive regulatory environment that balances innovation with investor protection, policymakers aim to unlock the full potential of security tokens as a transformative force in modern finance.