Layer 2 solutions in blockchain are technologies developed to overcome fundamental limitations of Layer 1 blockchain networks like Bitcoin and Ethereum, primarily in terms of scalability, costs, and transaction speed. Imagine Layer 1 blockchain as a main highway with a limited number of lanes: when traffic is low, all cars (transactions) can freely move and reach their destination quickly. However, as traffic increases, the highway gets congested, slowing down everyone’s journey and increasing toll costs for those wanting to prioritize their passage.

This analogy reflects the scenario faced by many Layer 1 blockchains, where the increase in the number of users and transactions has led to slower processing times and higher transaction fees. In this context, Layer 2 solutions emerge as secondary networks or technologies operating “above” the main blockchain, akin to express lanes or alternative routes allowing users to transact more efficiently.

The main goal of L2 solutions is to enhance the network’s capacity to handle a much larger transaction volume at a faster speed and lower cost, without compromising the fundamental security and decentralization features of the underlying chain. They achieve this through different approaches, such as payment channel networks, enabling near-instant transactions between parties; rollups, bundling multiple transactions into a single batch for processing; and sidechains, which are independent chains connected to the main chain, each designed for specific use cases or applications.

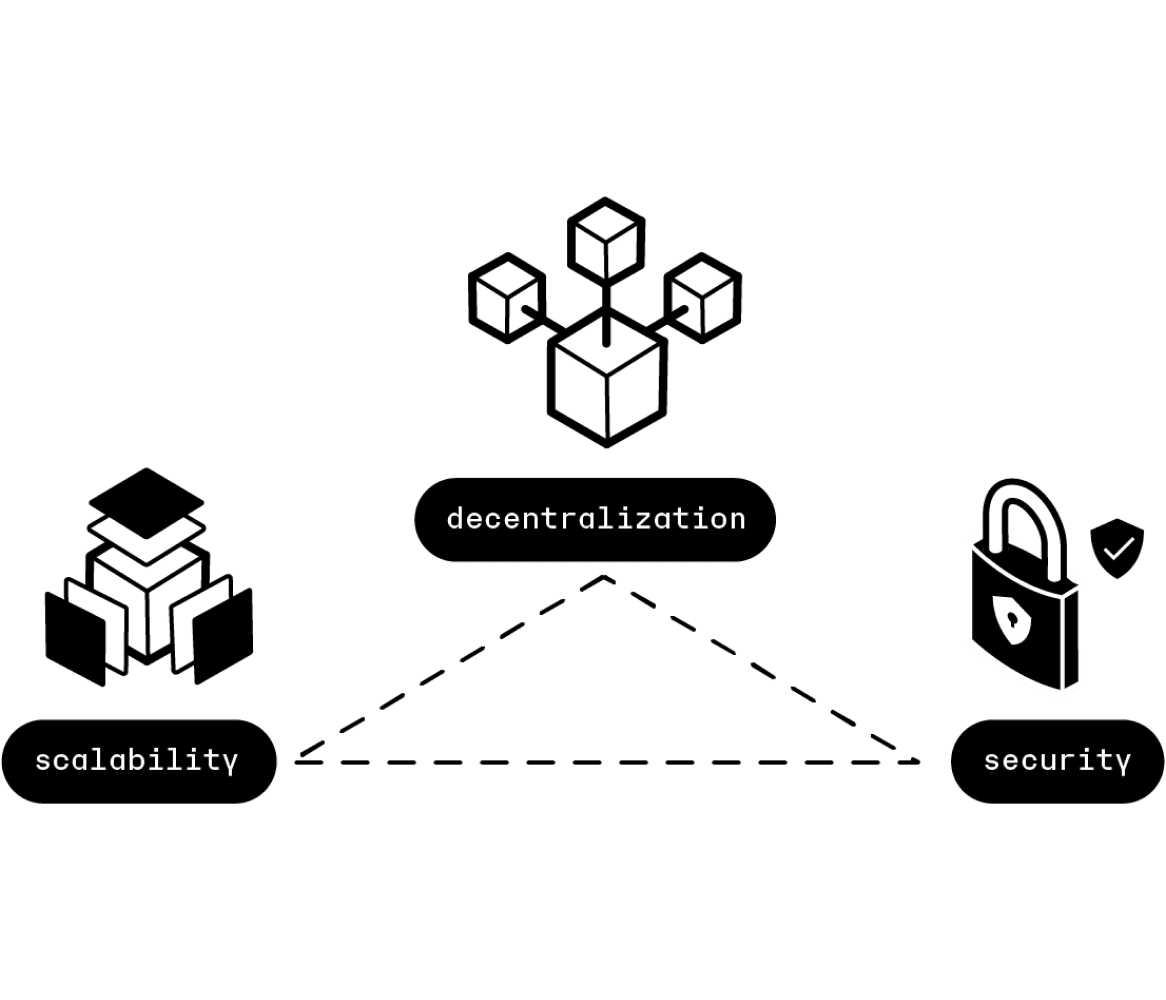

Scalability Challenges in Ethereum: Navigating the Trilemma

As Ethereum solidified its position as a leading platform for smart contracts and decentralized applications (DApps), it faced a crucial challenge known as the “blockchain trilemma.” This trilemma, conceptualized by Ethereum co-founder Vitalik Buterin, poses the daunting task of balancing three key elements: security, decentralization, and scalability.

In simple terms, the trilemma suggests that improving Ethereum’s scalability without compromising security and decentralization is a complex task. The Ethereum blockchain operates on decentralized consensus, meaning all transactions must be validated by nodes distributed across the network. This approach ensures the network’s integrity but also limits speed and efficiency.

Increased demand for transactions and the growing complexity of DApps have led to congestion issues on Ethereum’s main chain. Currently, high transaction fees and longer confirmation times have created significant hurdles for mass adoption and the long-term viability of the network.

It is in this context that Layer 2 Solutions emerge as an innovative response to the scalability trilemma, offering a way to increase the network’s capacity without sacrificing its inherent security and decentralization. Below, we’ll explore how these solutions are reshaping the Ethereum landscape and opening new possibilities for its users.

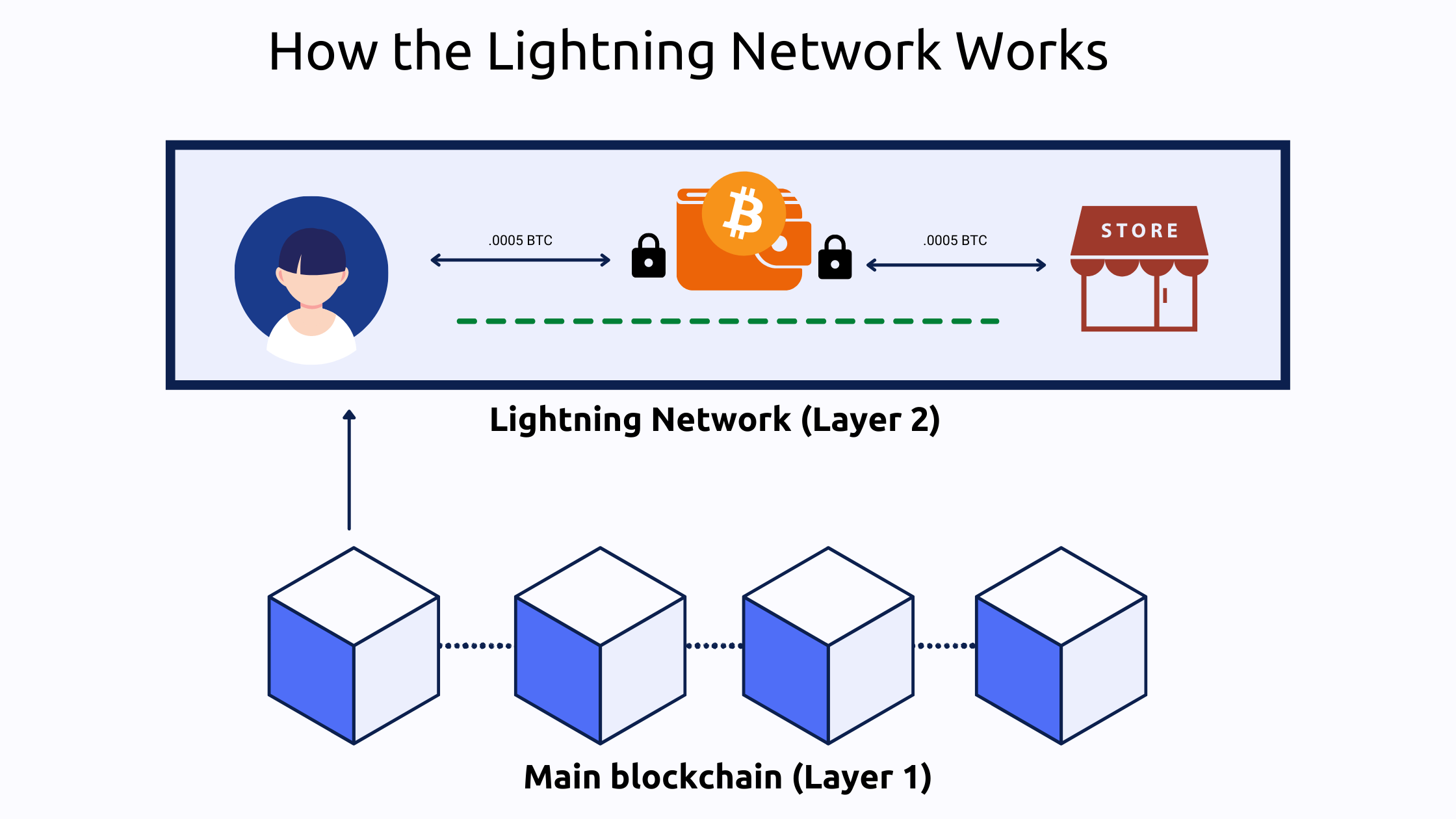

Payment Channel Networks

Payment channel networks represent one of the most promising and effective Layer 2 solutions to address scalability issues and high transaction fees on blockchains. These networks enable near-instant transactions between parties, with significantly lower fees, facilitating a much larger volume of transactions without overburdening the main network. This concept is detailed below, providing examples, advantages, and associated challenges.

Concept and Operation

A payment channel network is a system that allows two or more parties to make multiple transactions without the need to record each one on the blockchain. Essentially, this mechanism creates a private payment channel between the parties, off the main chain, where they can exchange an unlimited number of transactions. Only two transactions are recorded on the blockchain: the opening of the channel and its closure. Opening the channel involves locking a certain amount of cryptocurrency in a smart contract as collateral, while closing the channel settles the final state of transactions between the parties, adjusting their balances accordingly.

Examples

The most well-known example of a payment channel network is the Lightning Network for Bitcoin. The Lightning Network facilitates fast and low-cost transactions between participants and is especially useful for small payments and micropayments, where transaction fees and confirmation times on the main blockchain would be prohibitive. Other cryptocurrencies, like Ethereum, are also exploring similar payment channel networks, such as Raiden Network, to improve transaction efficiency.

Advantages

- Fast and Economical Transactions: Transactions are conducted instantly and with minimal fees since they don’t require validation by the entire network.

- Improved Scalability: By handling transactions off the main chain, payment channel networks alleviate congestion and allow the blockchain to scale to support a much larger volume of transactions.

- Increased Privacy: Transactions within a channel are not public, offering greater privacy to the involved parties.

Challenges

- Need for Locked Funds: To open a channel, parties must lock funds, which can be inefficient if needed elsewhere.

- Complexity and Usability: Setting up and managing payment channels can be complex for non-technical users, limiting mass adoption.

- Centralization Risk: There’s a risk of the network centralizing around large, well-connected nodes that facilitate most transactions.

Payment channel networks represent a significant advancement in the quest for scalable blockchain solutions. Despite their challenges, their development and adoption continue to progress, suggesting a significant role in the future of digital transactions and cryptocurrency usage.

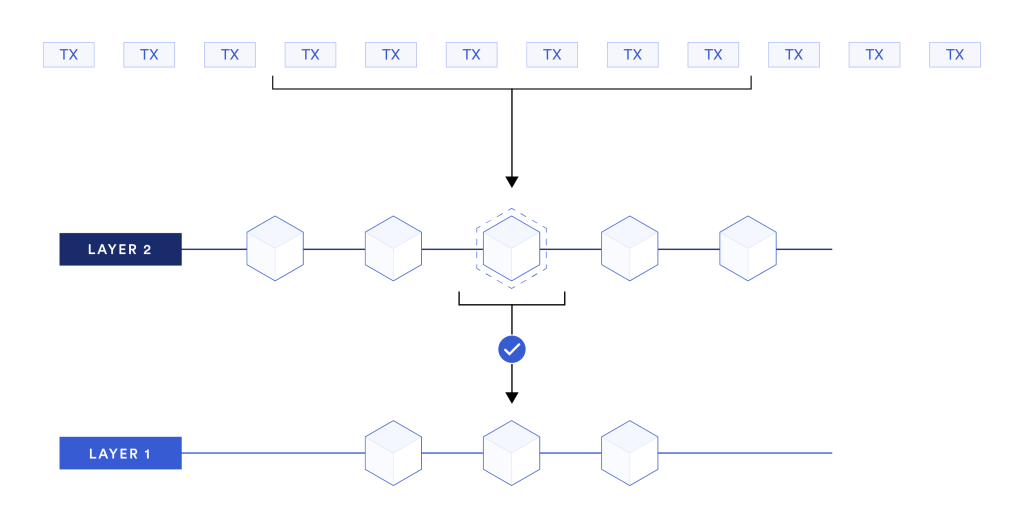

Rollups

Rollups are another crucial innovation in the Layer 2 solutions ecosystem, designed to address scalability and efficiency challenges in blockchains. They work by aggregating or “rolling up” multiple transactions into a single package processed off the main chain but whose final outcome is recorded on it. Rollups leverage the security and decentralization of the main chain while significantly increasing the number of transactions that can be processed. There are two main types of rollups: Optimistic Rollups and Zero-Knowledge Rollups (ZK Rollups), each with its own characteristics and advantages.

Explanation of Rollups and How They Work

Rollups execute transactions off the main chain and generate proof or evidence of these transactions. This proof is then published on the main chain, allowing verification of the final state of transactions without the need to individually process each one on the chain. This technique significantly reduces the load on the main network and enables lower fees and faster processing times, while still maintaining a high level of security and reliability.

What are the differences between Optimistic Rollups and ZK Rollups?

- Optimistic Rollups: Operate under the assumption that all transactions are valid by default and only perform full verification computations if a challenge is raised against a transaction. This reduces the amount of computation needed but requires a “challenge” period where transactions can be disputed before ultimately being accepted on the main chain.

- Zero-Knowledge Rollups (ZK Rollups): Use cryptographic proofs (zero-knowledge proofs) to demonstrate the validity of all transactions in the batch without revealing any specific information about them. This allows for quick and efficient verification without the need for a challenge period, making ZK Rollups generally faster than Optimistic Rollups.

Use Cases and Benefits

- Efficiency and Scalability: Both types of rollups can process thousands of transactions per second (TPS), significantly surpassing Layer 1 blockchain capabilities.

- Cost Reduction: By processing transactions off the main chain, rollups drastically reduce gas fees.

- Security: Despite processing transactions off the main chain, rollups maintain a high level of security by anchoring the final state of transactions on the main chain.

Challenges

- Technical Complexity: Implementing rollups is technically complex, which may hinder adoption by some projects.

- Interoperability: Interoperability between different rollup solutions and with the main chain can be a challenge.

- User Adoption: Transitioning to rollup-based systems requires changes in how users interact with DApps and blockchains, which may require an adaptation period.

Rollups represent a significant advancement in solving blockchain scalability issues. With their distinct advantages, both Optimistic Rollups and ZK Rollups are poised to play important roles in the future of cryptocurrency space, enabling greater transaction volume and wider adoption of blockchain technology.

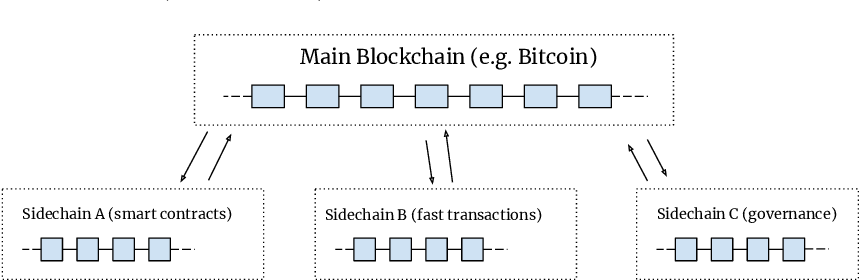

Sidechains

Sidechains are independent blockchains that operate alongside the main chain, allowing asset transfer between them. This Layer 2 solution is designed to expand the capacity and functionality of a blockchain without compromising its security and decentralization. Through sidechains, it’s possible to experiment and implement specific features that wouldn’t be practical or possible on the main chain, offering significant flexibility for decentralized application development and new use cases.

Definition and Operating Mechanism

A sidechain is a blockchain that operates independently of the main chain but is connected to it through a mechanism of token locking and release, known as a “two-way peg.” This mechanism allows assets to be transferred from the main chain to the sidechain and vice versa, maintaining a secure and verifiable link between the two. Assets locked on the main chain are released on the sidechain, allowing their use within this new environment, and can be transferred back through a reverse process.

Examples and Practical Applications

- Liquid Network: A Bitcoin sidechain designed to facilitate fast and private transactions between businesses, such as exchanges and financial service providers.

- Polygon (formerly Matic Network): A scalability platform for Ethereum using sidechains to offer high-speed, low-cost transactions.

- Ronin: A sidechain specifically designed for the blockchain game Axie Infinity, enabling transactions and asset management within the game more efficiently.

Advantages

- Scalability: Sidechains alleviate the load on the main chain by handling specific transactions and applications on a separate chain.

- Flexibility: They allow for the implementation of unique rules, consensus mechanisms, and features without affecting the security or operation of the main chain.

- Innovation: They facilitate experimentation and the development of new applications and technologies in a secure and controlled environment.

Limitations

- Security: While sidechains are designed to be secure, their level of security may depend on their own consensus mechanism and the robustness of their connection to the main chain.

- Integration Complexity: Establishing and maintaining interoperability between the main chain and sidechains can be technically challenging.

- User Adoption and Liquidity: For a sidechain to be successful, it needs to develop its own ecosystem of users and applications, which may require significant time and effort.

Sidechains offer a versatile and powerful solution for scalability and innovation in the blockchain space. By providing an environment for rapid development and implementation of new features without overburdening the main chain, sidechains play a crucial role in the evolution and adoption of blockchain technology.

Plasma

Plasma is a proposed conceptual framework to improve blockchain scalability by creating “child chains,” or secondary blockchains, that are anchored to a main chain. This Layer 2 solution enables transaction processing and execution of smart contracts on these child chains, significantly reducing the load on the main chain. Plasma is specifically designed for the Ethereum network, aiming to expand its processing capacity and efficiency.

Concept and Plasma Architecture

The idea behind Plasma is to create a tree of blockchains where each child chain can, in turn, generate its own child chains, creating a multi-level structure. Transactions are processed and finalized on these secondary chains, while the security and data integrity are maintained thanks to the Ethereum main chain. Each child chain operates with its own consensus mechanism, allowing for great flexibility and scalability.

A key feature of Plasma is the use of “Merkle trees” to compress the state of the child chain and send it to the main chain. This ensures that, although transactions are processed on a secondary chain, their finalization and security are backed by the security of the main chain.

How Plasma Facilitates Secure Asset Transfer

Plasma facilitates secure asset transfer between the main chain and child chains through the use of smart contracts. Users can deposit assets into a smart contract on the main chain, which are then represented on a child chain where they can be transacted with greater speed and lower cost. To withdraw the assets, users initiate a withdrawal process on the child chain which, after a challenge period to allow for verification and response to fraudulent transactions, is finalized on the main chain.

Challenges and Considerations

- Implementation Complexity: The design and operation of Plasma are complex, posing challenges in its implementation and adoption.

- Usability Issues: The need to interact with multiple chains and manage deposit and withdrawal processes can complicate the user experience.

- Security Risks in Child Chains: Although the security of the main chain supports the child chains, the latter may be more vulnerable to attacks if not properly designed or managed.

Impact on Ethereum Scalability

Plasma represents an innovative approach to addressing scalability and efficiency challenges in Ethereum, enabling a greater number of transactions and decentralized applications without compromising security. Although its practical implementation has faced challenges, the concept of Plasma has influenced the development of other scalability solutions and has significantly contributed to the debate and innovation in the blockchain space.

In conclusion, Plasma offers a promising framework for improving the scalability and efficiency of blockchains through the creation of child chains. Despite the challenges it faces, its development and implementation remain areas of interest for researchers and developers seeking to overcome the obstacles of existing blockchain technologies.

Comparison between Layer 2 Solutions

Innovation in the Layer 2 solutions space is driven by the common goal of addressing the scalability, cost, and speed challenges faced by Layer 1 blockchains. Each L2 solution, from payment channel networks to rollups and sidechains, offers a unique approach to addressing these issues. Below is a detailed comparison of these solutions in terms of speed, security, costs, and suitable use cases, providing a clear perspective on how they differ and when one might be preferable over another.

Transaction Speed

- Payment Channel Networks: Offer nearly instant transactions between parties that have established a channel, ideal for micropayments and frequent transactions among a fixed set of users.

- Rollups: Significantly improve processing speed by batching many transactions into a single batch before sending it to the main chain. ZK Rollups are generally faster than Optimistic Rollups due to their efficient verification mechanism.

- Sidechains: Speed can vary significantly depending on the specific implementation and consensus mechanism of the sidechain, but in general, they enable faster transactions than on the main chain.

Security

- Payment Channel Networks: Security depends on the design of the channel and the parties’ ability to monitor and respond to disputes. Although secure for transactions between channel parties, they require continuous monitoring.

- Rollups: Provide a high level of security by anchoring the state of transactions on the main chain. ZK Rollups offer additional security through cryptographic proofs without revealing transaction details.

- Sidechains: Security varies and is generally lower than on the main chain, as it depends on the design of the sidechain and its consensus mechanism. Assets may be at risk if the sidechain is compromised.

Costs

- Payment Channel Networks: Fees are minimal or non-existent within the channel, making them ideal for small and frequent transactions.

- Rollups: Significantly reduce transaction fees by processing many transactions as one on the main chain. ZK Rollups, in particular, optimize costs by reducing the amount of data needed for verification.

- Sidechains: Transaction costs can be significantly lower than on the main chain, depending on the specific configuration and efficiency of the sidechain.

Suitable Use Cases

-

- Payment Channel Networks: Ideal for micropayments or frequent transactions among a limited set of users, such as in-game payments or streaming services.

- Rollups: Suitable for decentralized applications (dApps) requiring high processing capacity and cost efficiency, such as non-fungible token (NFT) markets or decentralized exchanges (DEX).

- Sidechains: Beneficial for specific use cases requiring unique rules or capabilities not available on the main chain, such as proofs of concept, blockchain games, or enterprise applications.

The Future of Layer 2 Solutions and Their Impact on Blockchain

The development and implementation of Layer 2 solutions are marking a turning point in the evolution of blockchain technology. These innovations not only address existing challenges of scalability, costs, and transaction speed, but also open up new avenues for the adoption and application of blockchains across various sectors. As these solutions mature and become more deeply integrated into the blockchain ecosystem, their impact is likely to be significant and multifaceted.

Current and Potential Innovations in the Layer 2 Space

Layer 2 solutions are constantly evolving, with new developments and improvements being introduced regularly. Among these innovations, we can highlight:

- Enhanced Interoperability: Efforts to improve interoperability between various Layer 2 solutions and between Layers 1 and 2 are ongoing. This is crucial for creating a cohesive and efficient blockchain ecosystem where assets and information can flow freely and without friction.

- Rollup Optimization: Continuous optimization of rollups, both Optimistic and ZK, promises to further improve speed and reduce transaction costs. This includes research into advanced cryptographic techniques and more efficient consensus mechanisms.

- Zero-Knowledge Proof Technologies: The expansion of zero-knowledge proof (ZK) technologies beyond ZK Rollups could offer new ways to ensure privacy and security in blockchain transactions and applications.

Impact of Layer 2 Solutions on Mass Adoption of Blockchain

Mass adoption of blockchain technology has been limited by concerns related to scalability, transaction speed, and costs. Layer 2 solutions directly address these issues, facilitating:

- Increased Scalability: By enabling a higher volume of transactions, L2 solutions make blockchains more practical for a variety of applications, from payments to decentralized applications (dApps).

- Cost Reduction: Reduced transaction costs open the door to new business models and applications, especially those involving micropayments or requiring high transaction frequency.

- Improved User Experiences: Faster and cheaper transactions significantly enhance the user experience, which is vital for the widespread adoption of blockchain-based technologies.

Conclusion: Unleashing Ethereum’s Potential with Layer 2 Solutions

Through this in-depth exploration, we have unraveled the significant impact that Layer 2 solutions are having on the Ethereum ecosystem. From addressing the scalability trilemma to transforming practical use cases in DeFi, blockchain games, and NFT markets, these innovations are not only solving immediate problems but also unlocking Ethereum’s full potential.

Optimistic Rollup and zk-Rollup solutions have revolutionized transaction efficiency, allowing DeFi applications to operate faster and more affordably. Blockchain games, an emerging force, now experience more efficient transactions thanks to projects like Immutable X. NFT markets, which have conquered the cultural scene, are reaching new levels of accessibility and engagement through solutions like Plasma.

The improvement of user experience in dApps is evident, with State Channels and Optimistic Rollups leading the way to faster and cheaper transactions. This shift towards efficiency and affordability is paving the way for broader and more sustainable adoption of Ethereum, strengthening the narrative of a decentralized and functional blockchain. In summary, Layer 2 solutions are not only transforming Ethereum; they are unleashing its true potential.