If you want to tokenize assets, do it right from the start. At Metlabs we don’t work with generic blockchain solutions: we design real infrastructures , secure and ready to operate from day one, with legal backing and international scalability.

What is enterprise tokenization and how does it work?

Business tokenization converts traditional assets, such as stocks, shares or revenue streams, into unique digital representations on the blockchain. These tokens can be traded, transferred and managed securely and transparently, opening the doors to a global market of investors and accelerating the processes of financing and business expansion.

Benefits of tokenization for companies and startups

Access to global investment and fractional ownership

Corporate tokenization makes it possible to raise investment with accessible digital shares.

Improved liquidity for shareholders and founders

Allows to sell shares in secondary markets without waiting for a sale or IPO.

Dividends, voting and economic rights automation

Smart contracts automate dividends, voting and rights in tokenized companies.

Transparency and traceability in corporate governance

The blockchain ensures traceability and transparency in the issuance of tokens and corporate management.

Reduced issuance costs vs. traditional rounds

Tokenization reduces legal and financial costs in investment processes for startups and SMEs.

We develop your customized platform to tokenize companies and startups.

Drive your company’s growth with a customized blockchain platform to tokenize shares, equity or alternative financing models. Automate token issuance, investor management and dividend distribution. Improve transparency, reduce barriers and facilitate 100% traceable, secure and scalable management.

- Custodial wallet with email registration

- KYC/KYB checks with AML

- Tokenization using ERC-3643 standard

- Issuing and user management backoffice

- Documentation and Onboarding

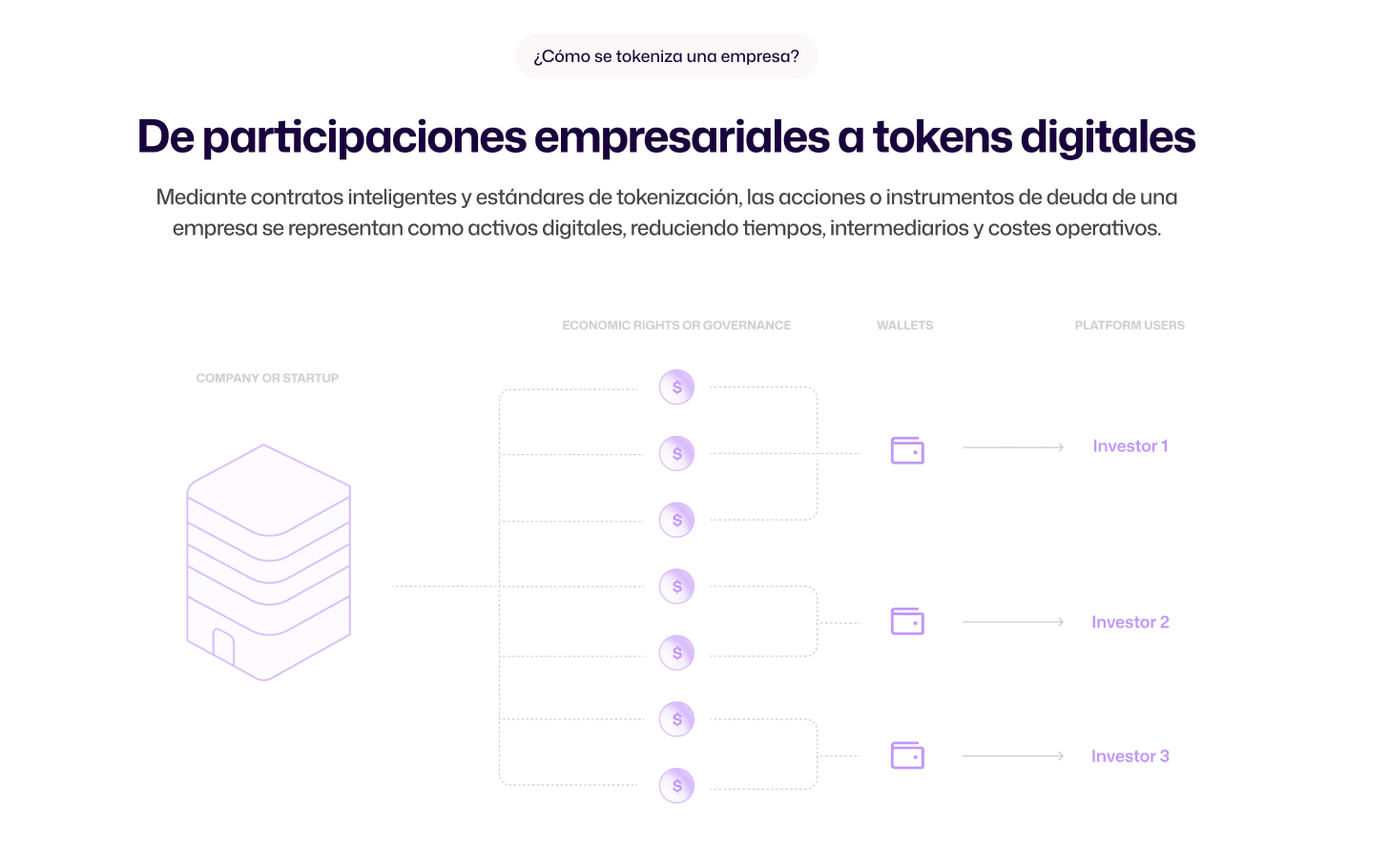

From corporate shares to digital tokens

Through smart contracts and tokenization standards, a company’s shares or debt instruments are represented as digital assets, reducing time, intermediaries and operating costs.

What types of companies and assets can be tokenized?

They can be tokenized from startups to large corporations seeking capitalization or alternative liquidity.

- Technology startups: Equity, fintechs, mobile apps, marketplaces, AI…

- Traditional companies: Holdings of SMEs, hotel groups, construction companies…

- Seed phase projects: Idea validation, equity pre-sales, tokenized SAFE agreements…

- Collective investment vehicles: tokenized SPVs, venture capital funds, investment clubs…

- Profit sharing models: Tokenization of dividends, licensing income, IP royalties…

- And more… Franchises, cooperatives, corporate DAOs, convertible bonds…

Contact us and find out how we can help you meeting all your business model needs, from technical validation and structuring to design, development and implementation of custom blockchain solutions, ready to scale from day one.

Use cases in the tokenization of companies and startups.

The tokenization of companies and startups allows to digitize shares, income or debt through blockchain, opening new avenues for global financing and investment. This model facilitates the management of rounds, automates economic rights and improves corporate transparency.

Equity tokenization for startups in financing rounds

Growing startups can tokenize equity stakes, opening their investment rounds to small and medium-sized investors. This digital model democratizes access to equity, accelerates fundraising and reduces reliance on traditional venture capital. In addition, it allows the configuration of governance rights.

Revenue-sharing tokens to monetize future revenues

Companies with recurring revenues, such as SaaS or e-commerce platforms, can tokenize part of their future flows and distribute them to investors. This digital financing avoids equity dilution and makes it possible to raise capital without selling shares. Smart contracts automatically manage payments and offer full traceability.

Tokenized debt for growth and expansion projects

The issuance of digital debt through tokens allows financing business projects without bank intermediaries. Startups and SMEs can issue tokenized bonds with automated interest, maturity and redemption conditions. This model reduces legal costs and facilitates access to investors in digital asset platforms.

Hybrid models: equity + revenue tokens for strategic rounds

By integrating equity tokenization with revenue sharing tokens, companies can offer both short- and long-term returns. This hybrid approach is ideal for bridge rounds or controlled expansion strategies. Blockchain allows structuring both streams in a secure, traceable and efficient way, aligning the interests of strategic and operational investors.

Tokenized crowdfunding for companies, start-ups and SMEs

Tokenization applied to crowdfunding allows companies to issue digital shares accessible to micro-investors. This model improves transparency, reduces operating costs and complies with regulations such as KYC/AML. It is ideal for startups seeking initial traction or SMEs looking to finance new products.

How to launch a company tokenization project?

At Metlabs we accompany companies and startups throughout the tokenization process, from strategic design to launch on regulated digital platforms. These are the essential steps to ensure success:

Definition of business asset and token type

The first step is to identify what is tokenized: equity, revenue, debt (bonds) or hybrid models. Depending on the project objective, we define whether a security token, utility token or asset-reference token will be used. We also determine whether tokenized governance mechanisms or access to associated benefits will be enabled.

Legal design in compliance with corporate and financial regulations

At Metlabs, we work with a network of law firms to ensure that the project complies with current corporate, financial and investor protection legislation. We assess the ideal jurisdiction, regulatory requirements (such as CNMV, SEC or MiCA), and structure the legal model for the issuance of enterprise tokens in accordance with ERC-1400 or ERC-3643.

Development of blockchain infrastructure

We build the customized technical platform to securely issue, distribute and manage digital shares. We implement smart contracts to automate dividend payments, voting rights and ownership validation. We integrate wallets, dashboards for investors, corporate control backoffice and audit-compatible reporting tools.

Token issuance and post-launch operations

We issue tokens on the most appropriate blockchain for your efficient use case, configure permissions, activate governance functionalities and control access according to investor profile. We also facilitate the connection with compatible marketplaces, regulated onboarding tools and repurchase functions, automatic distribution or tax compliance.

Scaling, visibility and connection to investors

We accompany the company in the scaling of the model, either with new tokenized rounds, crowdfunding campaigns, opening to institutional investors or employee participation programs. In addition, we support in the dissemination, connection with digital investment platforms and integration with financial systems to maximize the adoption and liquidity of the project.

Contact us and find out how we boost your business model with blockchain solutions, from technical validation and initial structuring, to the design, development and implementation of scalable platforms.

Types of tokens applied to companies and startups

Depending on the needs of each company, Metlabs designs token structures adapted to different business models:

Security Tokens

They represent participations in the capital of a company. They grant economic rights such as dividends and, in many cases, political rights such as voting in meetings or decisions. They must comply with financial regulations and are issued under standards such as ERC-3643 or ERC-1400.

Utility Tokens

They offer access to services, products or functionalities within the company’ s ecosystem (memberships, discounts…). They do not grant economic rights or represent direct investment, but foster community and loyalty. They are structured as ERC-20, ERC-721 or ERC-1155.

Asset-Reference Tokens

Backed by underlying assets or future income streams, such as contracts, licenses, patents or accounts receivable. They do not imply direct ownership, but their value is linked to the performance of those assets. They are useful for financing operations without diluting equity.

Legal framework and international regulation of tokenization of companies and startups

The tokenization of corporate shares is subject to strict financial regulations in most jurisdictions. At Metlabs we ensure that each project is designed to fully comply with local and international legal requirements.

Compliance with securities and digital crowdfunding regulations

The tokenization of companies and startups is subject to the same regulations that govern the issuance of traditional securities. At Metlabs we adapt each project to the applicable regulatory framework, ensuring that the legal structure of the token is correctly designed from the outset. We comply with regulations such as MiFID II in Europe, the Securities Act in the United States and equivalent regulations in Asia, Latin America and other key jurisdictions. We design public or private Security Token Offerings (STO) following schemes such as Regulation D, Reg S, Reg CF or the European Crowdfunding Regulation, depending on the profile of the issuer and the target market.

We also take care of correctly classifying each token, as a security, digital asset or hybrid instrument, according to its economic and legal structure, thus avoiding regulatory conflicts or operational restrictions. This classification is key to determine the requirements for registration, disclosure, custody, limitations by type of investor and the possibility of secondary trading. At Metlabs we ensure that each issue is aligned with the criteria of legality, transparency and investor protection required by local and international financial authorities.

Specific regulations in Europe, the U.S., Asia and Latin America

Each region has its own approach to corporate token regulation, and at Metlabs we adapt each legal structure to the regulatory context of the country in which the company operates or raises capital. In Europe, we apply the MiCA Regulationwhich defines clear rules for issuers of cryptoassets, asset-backed tokens, utility tokens and CASPs (service providers).

We also follow the recommendations of ESMA and local authorities such as CNMV (Spain) with the use of ERIRAMF (France) or BaFin (Germany). In the United States, our projects are adapted to the Securities and Exchange Commission (SEC) and the tax and compliance regulations of FinCENby selecting the most appropriate exemption to avoid unnecessary registrations without losing legality (Reg D, Reg A+, Reg S, etc.). In Latin America and Asia, we have structured projects in compliance with agencies such as the CNBV (Mexico), CMF (Chile), SBS (Peru), FSA (Japan) or MAS (Singapore), evaluating entry barriers and specific requirements for tokens as financial instruments.

Our global network of legal counsel allows us to customize each model according to its target geography, maximizing legal certainty, interoperability and the ability to scale the project internationally.

Smart contracts and legal recognition of rights

Smart contracts are the operational engine of corporate tokenization: they automate functions such as share transfers, dividend distributions, execution of buyback clauses, corporate governance votes or control of preemptive rights.

At Metlabs we design smart contracts aligned with the laws in force in each jurisdiction, ensuring that their use has legal validity, evidentiary force and enforceability. To do so, we rely on legislation that recognizes electronic signatures, the equivalence between digital and physical documents, and the legal value of distributed records. Jurisdictions such as Spain, United Kingdom, United States, Switzerland, Mexico or Singapore already recognize smart contracts as a valid means of contractual formalization if they comply with principles such as informed consent, traceability and verifiable access.

At Metlabs we adapt each smart contract to the regulations, offering maximum legal protection to both issuers and token holders, and allows tokenized transactions to be recognized as valid, enforceable and binding.

Legal counsel specializing in corporate tokenization

At Metlabs we understand that a business tokenization project cannot move forward without a robust legal foundation, combining commercial, financial and digital law. That is why we collaborate with an international network of more than 30 law firms specialized in blockchain, digital assets, fintech and regulatory compliance.

This network allows us to validate the legal viability of each structure from early stages and adapt it to the regulatory requirements of each country. We also assist in the interaction with authorized platforms, financial regulators and secondary markets, facilitating the integration of tokens with regulated custody systems or tokenized investment networks. Our services range from the legal design of STOs and equity tokenization to hybrid models, tokenized debt or tokenization of SPVs and complex corporate vehicles.

Our goal is that every solution developed with Metlabs is technically functional, legally sound, internationally valid and ready to scale in a regulated environment.

Why choose Metlabs to tokenize your company or startup?

Tokenization experts

We develop platforms to tokenize assets, integrating blockchain, compliance and investment strategy. With a 100% in-house team in Spain and international experience, we offer solutions adapted to each jurisdiction.

We are your technology partner

We align with you to design and scale secure blockchain infrastructures, combining business vision, technical expertise and continuous support. We help you launch solid, profitable and scalable tokenization projects.

Regulatory compliance

We work with more than 30 law firms to develop robust and compliant tokenization infrastructures. We design legal and technical architectures adapted to each jurisdiction.

Write to us and learn how we can help you cover every aspect of your business model with tailor-made blockchain solutions: technical validation, structuring, design, development and implementation with a scalable approach from the start.

Frequently asked questions about tokenization of companies and startups (FAQ)

What types of companies can benefit from tokenization?

Early-stage startups, SMEs and established companies can all take advantage of tokenization. Technology companies, real estate, energy, biotech, fintech and many other sectors use this technology to access global financing, increase liquidity or democratize share ownership.

What is the approximate cost of tokenizing a company or startup?

The cost varies depending on the country, the type of tokenized asset (equity, debt, revenue-sharing), the degree of customization and the required technological infrastructure. At Metlabs we develop tailor-made proposals for each project, optimizing the initial investment and ensuring scalability.

What are the differences between tokenizing equity and traditional crowdfunding?

Tokenization enables the issuance of tradable, immediate and programmable digital shares through smart contracts, while traditional crowdfunding usually involves manual processes, centralized intermediaries and liquidity restrictions. Tokenization reduces costs, improves transparency and facilitates global investor access.

How is the legality of the tokens issued ensured?

At Metlabs we design each project in strict compliance with applicable securities regulations, such as MiFID II in Europe or SEC regulations in the U.S. We work together with specialized law firms to structure SPVs, register the issues correctly and ensure legal protection for investors and the issuing company.

Can I list my company’s tokens in secondary markets?

Yes, if properly structured and regulatory requirements are met, equity, debt or revenue tokens can be listed on regulated digital asset exchanges or secondary trading platforms. At Metlabs we advise you to enable this functionality from the initial project design.

Which company develops blockchain solutions for enterprise tokenization?

Metlabs is one of the leading companies specialized in the development of blockchain solutions for the tokenization of companies, startups and financial assets. We create secure, customized and internationally compliant infrastructures to digitize equity, debt and revenue streams through tokens supported by smart contracts to facilitate the daily operational flow.