In the current context of cryptocurrencies, where technological innovation is constant, the concept of decentralized finance (DeFi) has captured the attention of investors, developers, and sector enthusiasts. DeFi promises to change the financial sector by offering open, transparent, and accessible services for all, eliminating intermediaries, and reducing costs. However, when it comes to Bitcoin, the pioneering cryptocurrency and the most valuable by market capitalization, a question arises: Is it possible and realistic to implement DeFi on Bitcoin?

This article will attempt to answer this question, exploring the technical fundamentals of Bitcoin, its capabilities, and limitations to support DeFi applications. We will address innovations seeking to overcome these limitations, such as second-layer solutions and sidechains, and how these technologies can facilitate the development of DeFi on the Bitcoin blockchain. We will also examine the inherent challenges in this endeavor, including scalability, interoperability, and user experience, as well as the security and decentralization implications that are central to the Bitcoin philosophy.

What are Decentralized Finance or DeFi?

Decentralized Finance (DeFi) represents an emerging paradigm within the cryptocurrency and blockchain ecosystem that seeks to replicate and expand traditional financial services through the use of decentralized technology. Unlike conventional finance (CeFi), which relies on centralized institutions such as banks, brokerage firms, and insurance companies to act as intermediaries and trusted guarantors, DeFi operates on a distributed infrastructure, usually on the Ethereum blockchain, although it is also being developed on other blockchains such as Binance Smart Chain, Polkadot, Solana, among others. In this article, we will focus on decentralized finance on the Bitcoin blockchain.

What is Bitcoin?

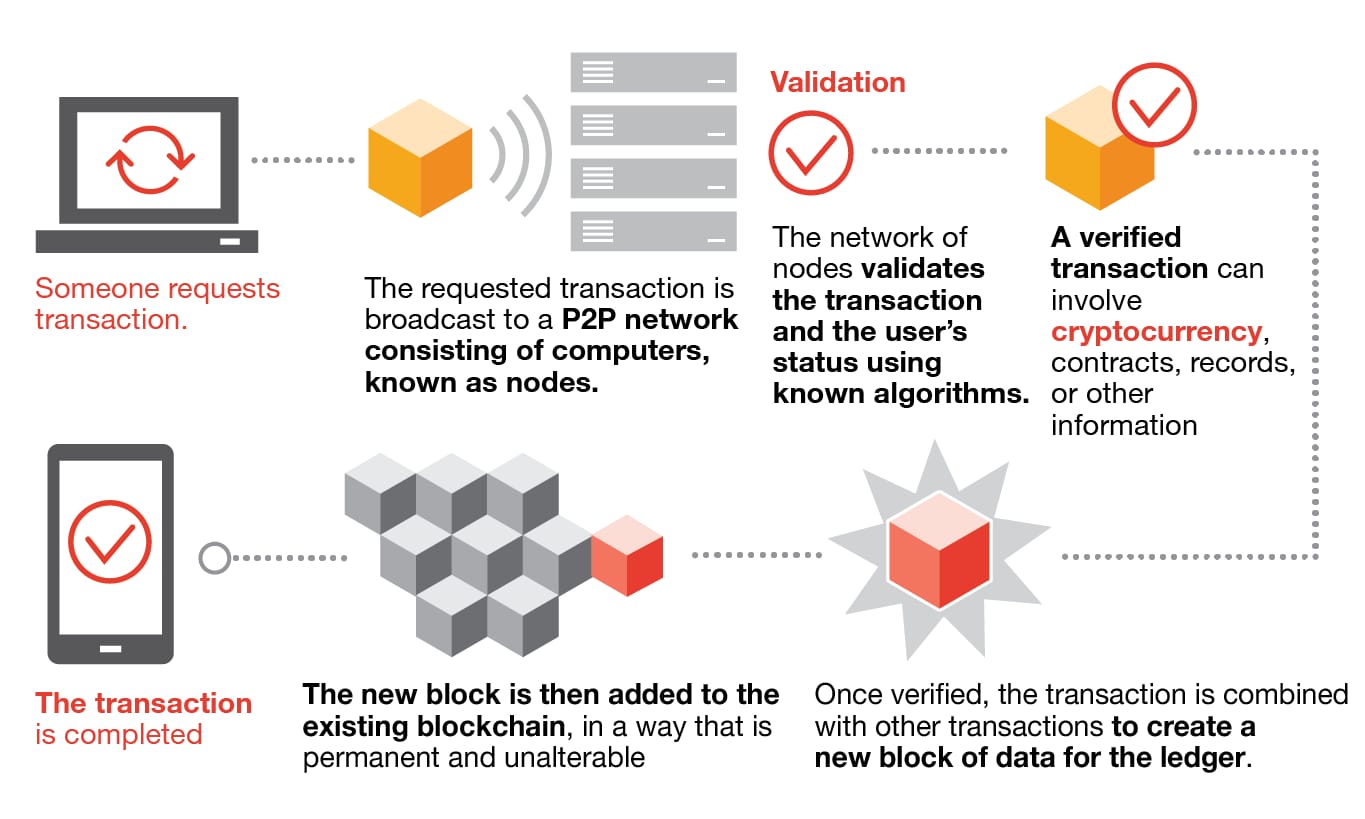

Bitcoin is a decentralized cryptocurrency created by an individual or group under the pseudonym Satoshi Nakamoto in 2008. It operates on a peer-to-peer network, meaning that transactions are conducted directly between users without the need for intermediaries such as banks or governments.

Bitcoin uses a proof-of-work consensus algorithm (PoW) to validate and confirm transactions on the network. Miners compete to solve complex mathematical problems to add new blocks to the blockchain and receive rewards in the form of bitcoins. Once a transaction is confirmed on the Bitcoin blockchain, it is practically impossible to reverse, providing security against fraud and chargebacks. Additionally, all these transactions on the Bitcoin network are public and can be viewed on the block explorer, providing transparency. However, the identities behind Bitcoin addresses are pseudonymous, providing a certain level of privacy.

When it comes to DeFi on Bitcoin, there are significant challenges, as we will explain below, due to the nature of the network. Unlike other more flexible blockchains, such as Ethereum, Bitcoin was not originally designed with advanced smart contract capabilities. This limits the possibilities of developing complex DeFi applications on the Bitcoin network. Additionally, scalability and transaction fees can be an issue during times of high demand, which can hinder the efficient execution of DeFi applications. However, despite these challenges, some projects are exploring ways to bring DeFi to the Bitcoin network.

Technical Features of DeFi on Bitcoin

Focusing on DeFi on Bitcoin, it is important to recognize that, unlike Ethereum and other blockchains designed with native smart contract capabilities to facilitate complex DeFi applications, Bitcoin was initially created as a peer-to-peer electronic cash system. However, over the years, several solutions and platforms have been developed to extend Bitcoin’s capabilities and enable DeFi functionalities. These technical solutions mainly include sidechains, compatible smart contract platforms, and second-layer protocols.

Sidechains

A sidechain is a separate blockchain that is connected to the main blockchain (in this case, Bitcoin) through a bidirectional bridge mechanism. This allows assets to move between the Bitcoin blockchain and the sidechain, facilitating the creation of applications that can leverage the unique features of both blockchains.

Liquid Network

Liquid is a Bitcoin sidechain focused on fast transaction settlement, enhanced privacy for participants, and the issuance of digital assets, such as tokens representing stocks, bonds, or other cryptocurrencies. It uses a federated consensus mechanism, where selected participants (mostly exchanges and financial service providers) operate the nodes that validate and confirm transactions.

RSK (Rootstock)

RSK is a Bitcoin sidechain that adds smart contract functionalities, allowing the development of decentralized applications and financial services on the security of the Bitcoin network. It also uses a bidirectional bridge mechanism to enable the movement of bitcoins to and from RSK, and employs a Merged Proof of Work consensus model with Bitcoin, meaning that Bitcoin miners can participate in securing the RSK network without the need for additional hardware.

Second-Layer Protocols

Second-layer protocols are solutions built on top of the Bitcoin blockchain that aim to scale the network and improve its functionality without altering the base blockchain layer.

Lightning Network

The Lightning Network facilitates almost instant and very low-cost Bitcoin transactions, ideal for micropayments and significantly increasing Bitcoin’s potential for daily transactions. It operates by creating payment channels between parties, where transactions can be conducted off the main Bitcoin blockchain and only recorded on the blockchain when opening or closing a channel. This relieves the burden on the main network and allows for greater scalability.

Stacks

Stacks (formerly Blockstack) seeks to extend Bitcoin through a model of smart contracts and decentralized applications, using the security of the Bitcoin blockchain. Stacks introduces a new layer of smart contract for Bitcoin, allowing the development of DeFi and other dApps. It uses a unique consensus mechanism, Proof of Transfer (PoX), which anchors Stacks operations to the Bitcoin blockchain, ensuring transaction finality and security.

Challenges and Limitations of DeFi on Bitcoin

Implementing DeFi on Bitcoin faces several challenges and limitations, primarily derived from the intrinsic characteristics of the Bitcoin blockchain and the original system design. These limitations not only affect the ability to develop complex DeFi applications directly on Bitcoin but also pose challenges in terms of scalability, interoperability, and security. Some of these limitations and challenges are detailed below:

Bitcoin Design Limitations

Bitcoin has intentionally limited scripting language called Script, designed to secure transactions and control access to bitcoin tokens. While it allows for certain “if this, then that” logic, it is not as expressive or flexible as smart contract languages on other blockchains, such as Solidity on Ethereum. This limits the complexity of DeFi applications that can be built directly on Bitcoin without resorting to second-layer solutions or sidechains.

While the Lightning Network and other proposals aim to address Bitcoin’s scalability limitations for financial transactions, the network’s ability to handle complex and high-demand DeFi applications is limited compared to platforms specifically designed for that purpose. Transactions on the Bitcoin main network can be slow and costly, especially during periods of high demand.

Technical Challenges

While sidechains like RSK and second-layer solutions like the Lightning Network are promising for enabling DeFi on Bitcoin, developing and maintaining them securely is a considerable technical challenge. These technologies require complex infrastructure and robust security mechanisms to protect users’ assets and transactions.

The ability to interact with other blockchains and DeFi ecosystems is crucial for the expansion and adoption of decentralized financial services. The isolated nature of DeFi solutions built on or for Bitcoin may limit their utility and appeal, especially when compared to more interoperable ecosystems.

Bridges between Bitcoin and other blockchains or sidechains are critical for interoperability and asset movement. However, these bridges present potential vulnerability points that can be exploited by malicious actors, as seen in several security incidents in the crypto space.

Usability and Adoption Challenges

The user experience in DeFi applications on Bitcoin may be less intuitive and accessible compared to platforms dedicated to DeFi. The need to use bridges, sidechains, and understand the complexities of second-layer solutions can be a significant barrier for non-technical users.

There is a need to educate users not only about the benefits and opportunities of DeFi on Bitcoin but also about the risks and limitations. Understanding and trust in these technologies are essential for their adoption.

Additionally, the constantly evolving regulatory environment poses a challenge for all forms of DeFi, including implementations on Bitcoin. Legal uncertainty and potential regulatory restrictions can influence the development and adoption of DeFi services.

Advantages and Benefits of DeFi on Bitcoin

Implementing decentralized finance on Bitcoin offers several advantages and benefits, leveraging the security, robustness, and widespread adoption of Bitcoin as the leading cryptocurrency in the market. Despite the limitations and challenges associated with integrating DeFi services on Bitcoin, the advantages of developing and using these applications on the Bitcoin blockchain are significant. Some of these benefits are explored below:

Enhanced Security

Bitcoin possesses one of the most secure blockchain networks, backed by enormous computing power through its proof-of-work consensus mechanism (PoW).

Implementing DeFi on this network leverages this inherent security, reducing the risk of attacks and manipulations that are more common on less secure or mature networks.

By using decentralized protocols on Bitcoin, risks associated with intermediaries and counterparties are minimized, as transactions and contracts are automatically executed according to code, without the need to trust third parties.

Integration with the Bitcoin Economy

Bitcoin is the most well-known and widely adopted cryptocurrency, with the highest market capitalization. Developing DeFi services on Bitcoin opens up these services to a broad potential market of Bitcoin users and holders, fostering adoption and usage of DeFi services.

The ability to use Bitcoin directly as collateral in loans, derivatives products, and other DeFi financial services significantly expands investment and financing options for Bitcoin holders.

Innovation and Development of New Applications

Exploring DeFi on Bitcoin incentivizes innovation in second-layer technologies and sidechains, such as Lightning Network, RSK, and Liquid Network, driving the development of new applications and services that may not have been possible on the original Bitcoin blockchain.

Through these innovations, Bitcoin can expand its functionality beyond simply being a peer-to-peer electronic cash system, incorporating complex financial applications such as loans, derivatives, prediction markets, and more.

Interoperability and Compatibility

As solutions are developed to overcome the technical limitations of DeFi on Bitcoin, there is growing potential for interoperability with other blockchains and DeFi systems, leading to a more connected and efficient decentralized financial ecosystem.

The extensive existing infrastructure for storing, transferring, and managing Bitcoin can be leveraged for DeFi services, reducing the entry barrier for users and service providers.

Economic Resilience

By offering DeFi services on Bitcoin, the spectrum of available financial services in the cryptocurrency ecosystem is diversified, contributing to greater resilience and economic stability within the space.

As with other DeFi platforms, implementation on Bitcoin has the potential to offer financial services to unbanked or underbanked individuals around the world, leveraging the accessibility and decentralized nature of Bitcoin.

In conclusion, despite technical and operational challenges, the advantages of developing and using DeFi on Bitcoin are considerable. These benefits not only leverage the unique features of the Bitcoin network but also promote innovation, financial inclusion, and the expansion of decentralized financial services. As technology advances and existing obstacles are overcome, we are likely to see even greater growth and adoption of DeFi in the Bitcoin ecosystem.

Conclusion

Exploring the potential of DeFi (decentralized finance) on Bitcoin has revealed both promising opportunities and significant challenges. While Bitcoin was not originally designed with the complexity of smart contracts and decentralized financial applications in mind, the community has demonstrated a remarkable ability to innovate, creating solutions like sidechains, second-layer protocols, and smart contract platforms that are built on or around the Bitcoin blockchain. These innovations have begun to open the door to DeFi services on Bitcoin, leveraging its unparalleled security, well-established network, and market-leading liquidity.

However, the inherent technical limitations of the Bitcoin blockchain and the challenges associated with scalability, interoperability, and user experience remain significant obstacles to the development and widespread adoption of DeFi on Bitcoin. These challenges require ingenious solutions and, in some cases, compromises that may affect decentralization or security, aspects that are fundamental to the value and philosophy of Bitcoin.

Reflecting on the possibility and realism of DeFi on Bitcoin, it is evident that, while significant barriers exist, the potential to innovate and overcome these obstacles is large. The Bitcoin community has repeatedly demonstrated its ability to address complex problems, and the growing interest in DeFi could catalyze new technological developments and collaborations that make a robust and secure DeFi ecosystem on Bitcoin possible.

The evolution of DeFi on Bitcoin depends not only on overcoming technical challenges but also on navigating the regulatory landscape and fostering greater adoption and understanding among users. As infrastructure and solutions mature, and these concerns are addressed, DeFi on Bitcoin could offer a powerful and secure alternative to existing DeFi platforms, complementing and expanding the decentralized financial ecosystem.

Ultimately, the viability of DeFi on Bitcoin will hinge on striking a balance between technical innovation and fidelity to the principles of decentralization and security that are fundamental to Bitcoin. Although the path to a fully developed DeFi ecosystem on Bitcoin is complex and fraught with uncertainties, the effort to explore this potential is not only possible but also realistic, given the ever-evolving nature of blockchain technology and the innovative spirit of the blockchain community.